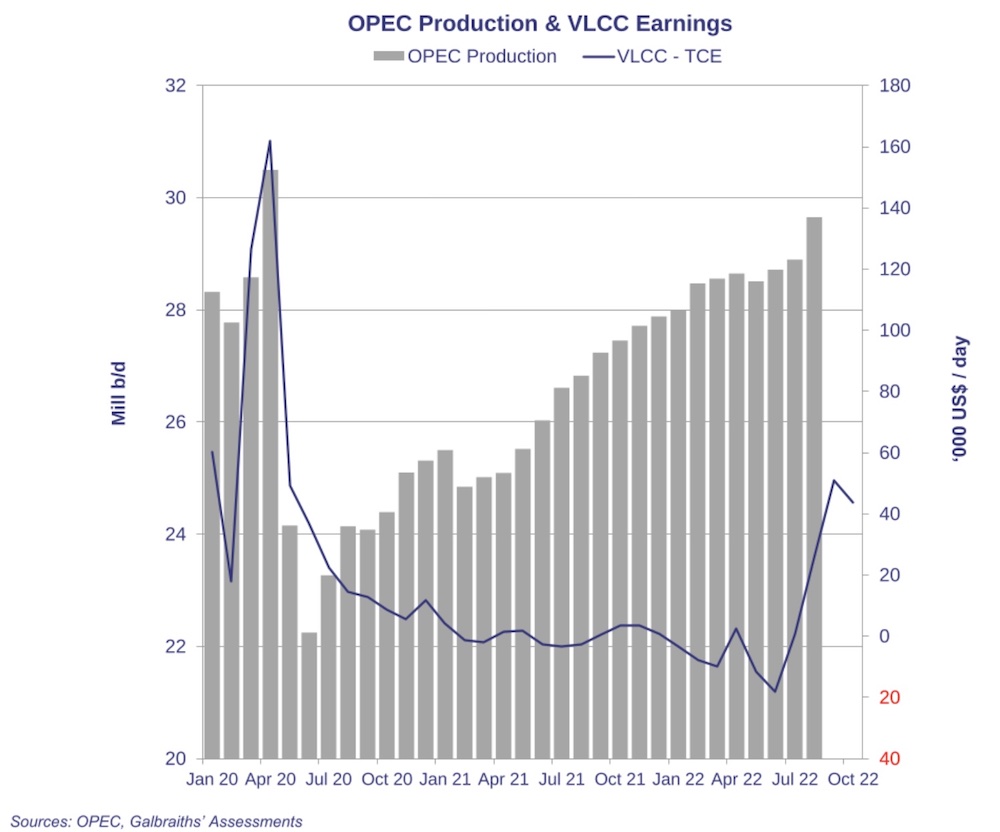

Cuts by OPEC+ seen putting the brakes on VLCCs

OPEC+ countries yesterday agreed on their deepest cuts to oil production since the onset of the covid pandemic with oil prices showing significant gains in the ensuing 24 hours.

Cuts of 2m barrels per day or 2% of global demand will kick in from next month.

“The cut is negative for tankers, though, based on current output, we expect the actual impact to production to be closer to 900,000 bpd,” a note from Jefferies suggested yesterday.

Analysts at Lorentzen & Co pointed out that the overall production cuts will be worked into lower baselines for each of the 10 OPEC producers bounded by restrictions and as well as the cooperating non-OPEC producers. Since many of the OPEC members are producing considerably less than their quotas, and the non-OPEC producer Russia is performing ever poorer, real cuts will be about 1m barrels per day, Lorentzen & Co estimated.

Given the new OPEC+ quotas are likely to impact long-haul trade, Jefferies, and other tanker analysts, see the VLCC segment as the most vulnerable to a lower cargo count.

“This move by OPEC could puncture some of the improved [VLCC] sentiment, as well as altering the fundamentals for lifting ex-MEG,” analysts at tanker broker Galbraiths predicted, reporting that the OPEC+ cut, on paper at least, represents a lost VLCC cargo every single day, representing a substantial increase in available tonnage in the Arabian Gulf, reversing some of the overall tightening that had helped drive freight upwards in recent weeks.

“Whilst globally tonne-miles are healthy and markets remain bullish heading into the winter months and beyond, this decision could put the brakes on an otherwise strong market,” Galbraiths suggested.