DNV GL’s 2050 forecast makes for sombre reading for tanker owners

Class society DNV GL has published its Maritime Forecast to 2050, which makes for good reading for those in container shipping, less so for traditional tanker owners.

The report explores how the expected shifts in energy production and demand, GDP growth, industrial production and regional manufacturing might change the maritime industry, and the impact on individual ship segments.

“Big and rapid changes are happening in the way the world uses and produces energy,” commented Remi Eriksen, group president and CEO of DNV GL. “Our Energy Transition Outlook (ETO) shows that by mid-century, the energy supply mix is likely to split equally between fossil and renewables. Advances in energy efficiency will also see the world’s demand for energy flattening after 2030. These trends will impact all players in the maritime sector.”

The forecast projects that heading to 2030, shipping will continue to enjoy robust growth. From 2030 to 2050, demand continues to increase, but less rapidly – with the growth primarily in non-energy commodities, such as the container trade and non-coal bulk. In addition to the changing energy production and export patterns, shipping’s fuel mix will become much more diverse. In 2050, oil will remain the main fuel option for trading vessels, but natural gas will step up to become the second-most widely used fuel, and new low carbon alternatives will proliferate.

“In the Maritime Forecast we can see the trends of today become the paradigms of tomorrow,” said Knut Ørbeck-Nilssen, CEO of DNV GL – Maritime. “Shipping will continue its drive for greater efficiency by reducing costs, improving utilization, lowering fuel consumption, increasing vessel size, and deploying new technologies. The current wave of digitalization transforming the industry will also have a profound impact – advancing design and operation and creating new business models.”

Delving into individual ship sectors, DNV GL forecasts that trade measured as tonne-miles will experience 2.2% annual growth over the period 2015– 2030 and 0.6% per year thereafter.

“Trade in individual energy commodities will decline as their use declines: coal first, then crude oil, thereafter oil products. Despite projected growth in oil imports in some regions, global seaborne crude oil and oil products, trade will reach peak volumes before 2030,” the report states.

Both LNG and LPG will experience sustained growth, as gas takes over as the largest energy source, DNV GL predicts.

Global gas consumption will decline after 2035, but growth in seaborne gas trade will be sustained as demand shifts to areas with less domestic gas and many new sources of unconventional gas are not connectable by pipelines.

Container growth is predicted by the class society to be “solid”, closely following GDP growth. The trade will experience the strongest growth of all segments, as measured by tonne-miles; 3.2% per year on average to 2030, driven by strong demand for consumer goods and continued containerisation. It will thereafter decline to average 2.1% per year. Over the entire forecasting period to 2050, annual growth will average 2.6% for container tonne-miles and 2.4% for global GDP; so, the container trade multiplier (trade growth relative to GDP growth) will average 1.1.

Bulk transport will continue to grow, but with notable cargo differences, DNV GL believes. Bulk commodities will see average growth of 1.8% per year in tonne-miles to 2030, and 0.6% per year thereafter, driven by strong increases in grain, moderate rises in ore and other minor bulk, and a decline in coal.

DNV GL is also predicting declining offshore oil and gas activity, and decreasing initiation of new fields, which will lead eventually to less offshore-related shipping activity, though fast growth in offshore wind will partly mitigate the reduction.

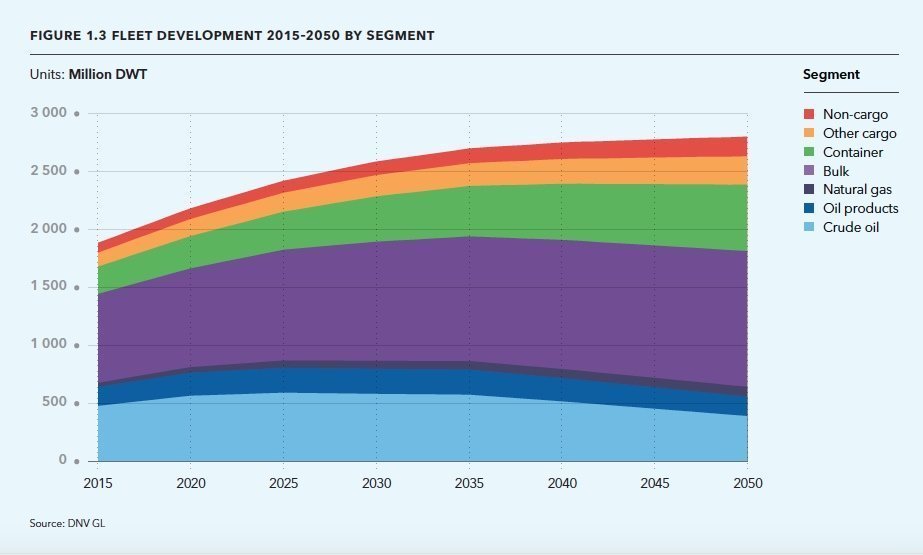

Measured by deadweight tonnage (dwt), the crude oil fleet will decline by approximately 20% by 2050, with the decline beginning after 2030. The product tanker fleet will remain stable. The bulk segment will experience a moderate growth of about 50%. The greatest increase comes in the container and gas segments where fleet tonnage rises almost 150% to mid-century, responding to increased trade.