Fleet supply and trade growth get the balance right for dry bulk

Owners are drawing strong encouragement for the near-term prospects of the freight markets and are right to do so, says Plamen Natzkoff from Maritime Strategies International.

In its latest, Q1 2024 forecast, Maritime Strategies International (MSI) forecasts a positive year for trade growth in the dry bulk sector, supported by signs of a broad-based improvement in economic activity across developed countries. In terms of supply, the forward newbuilding orderbook and delivery schedules remain relatively subdued across vessel sizes.

While each of those considerations on its own is unlikely to drive a sustained trend in freight earnings, their combination allows for market balances to tighten, especially in periods where the fleet’s efficiency may be impeded (for example by infrastructure bottlenecks) or we see short-lived surges in trade volumes.

MSI’s forecast for another year of relatively solid trade volume growth is supported by an improving economic backdrop with a considerably more positive environment for global trade compared to last year.

Improving fundamentals

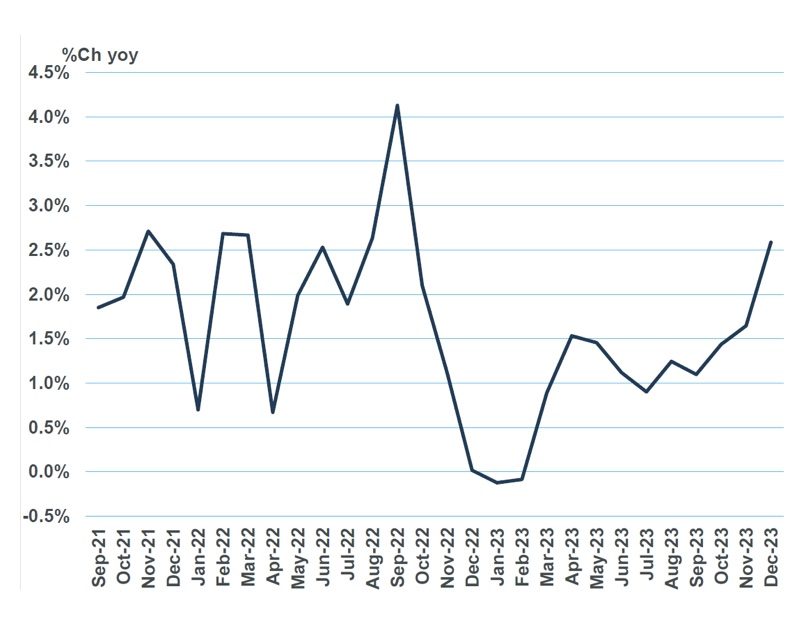

As Chart 1 shows, global industrial production growth (weighted by GDP) is significantly up on early-2023, with recent readings of over 2.5% being sharply up on the 0% growth seen at this time last year. Those improved fundamentals are driven by) improving support across developed economies including US, EU and Japan-Korea-Taiwan and year-over-year comparisons against the exceptionally weak Chinese performance at the tail-end of COVID-19 restrictions.

Looking ahead over the next several quarters, we anticipate that the recent steady improvement seen in developed economies is likely to persist. This will be supported by an expected loosening of monetary policy in the coming months, given the sharp deceleration of inflation rates across countries.

MSI’s forecasts for dry bulk commodity trade growth in 2024 are shaped by those macro considerations. Despite the well-known and persistent challenges in China’s property sector, a significant driver of the country’s steel demand, we note an improvement in steel fundamentals in the rest of the world.

Overall, we forecast another year of relatively strong aggregate dry bulk trade growth in 2024, with volumes rising by approximately 133m tonnes (or 2.6% yoy), albeit at a slightly weaker pace than previously predicted.

Capes lead the way

The last quarter of 2023 demonstrated that issues affecting the trading efficiency of the fleet can still have a significant impact on freight markets, with notable disruptions at the time including rising congestion and an effective closure of the Panama Canal to dry bulk vessels.

Since then, we have also seen widespread re-routing of vessels away from the Red Sea and the Suez Canal due to Houthi attacks on shipping. As we cautioned in our previous update, continued disruptions to the efficient deployment of the fleet have the capacity to absorb significant amounts of tonnage and affect the near-term freight market outlook.

The impact of those factors on freight rates has been realised through the past couple of months. The most notable effect has been on the capesize market, which has so far this year performed sharply better relative to typical seasonality.

Indeed, average monthly capesize rates in the first eleven weeks the year so far are running well ahead of recent comparables – almost three times higher (+185%) than rates in the same period of last year, and almost 2.5 times higher (+136%) than average Q1 rates over the previous five years.

This is in sharp contrast to the performance of the other dry bulk markets, where performance has been much closer to seasonal norms. For example, so far this quarter the panamax market is up only 10% relative to its average Q1 performance over the past five years, while the supramax and handysize markets are down by -2% and -7% respectively.

We anticipate that any upcoming increases in ECSA (soybeans) and US Gulf (coal, petcoke) trades, when combined with longer sailing distances required, have the potential to significantly tighten the market balances for panamax and supramax vessels in particular. The implication of this dynamic is that panamax and supramax rates could follow capes and see meaningful increases in the coming months following any seasonal improvement in trade volumes.