HMM, ONE and Yang Ming urgently seek to fill Hapag-Lloyd void

Reliability is king was the message coming from both Hamburg and Copenhagen yesterday as new liner partners, Hapag-Lloyd and Maersk, sought to explain their mission priorities in establishing the Gemini Cooperation, a liner marriage that has left certain Asian carriers reeling.

In agreeing to partner with Maersk from February next year on the main east-west trades, Hapag-Lloyd has torn up today’s existing alliance structure with its current group, THE Alliance suddenly finding itself with a small global presence.

Maersk’s existing partnership with Mediterranean Shipping Co (MSC), 2M, is due to expire in a year’s time and the Danish liner has been actively seeking a partner to plug capacity gaps.

In forming the so-called Gemini Cooperation with Hapag-Lloyd from February next year, members of THE Alliance, where the German carrier currently resides, will see the exit of its largest carrier.

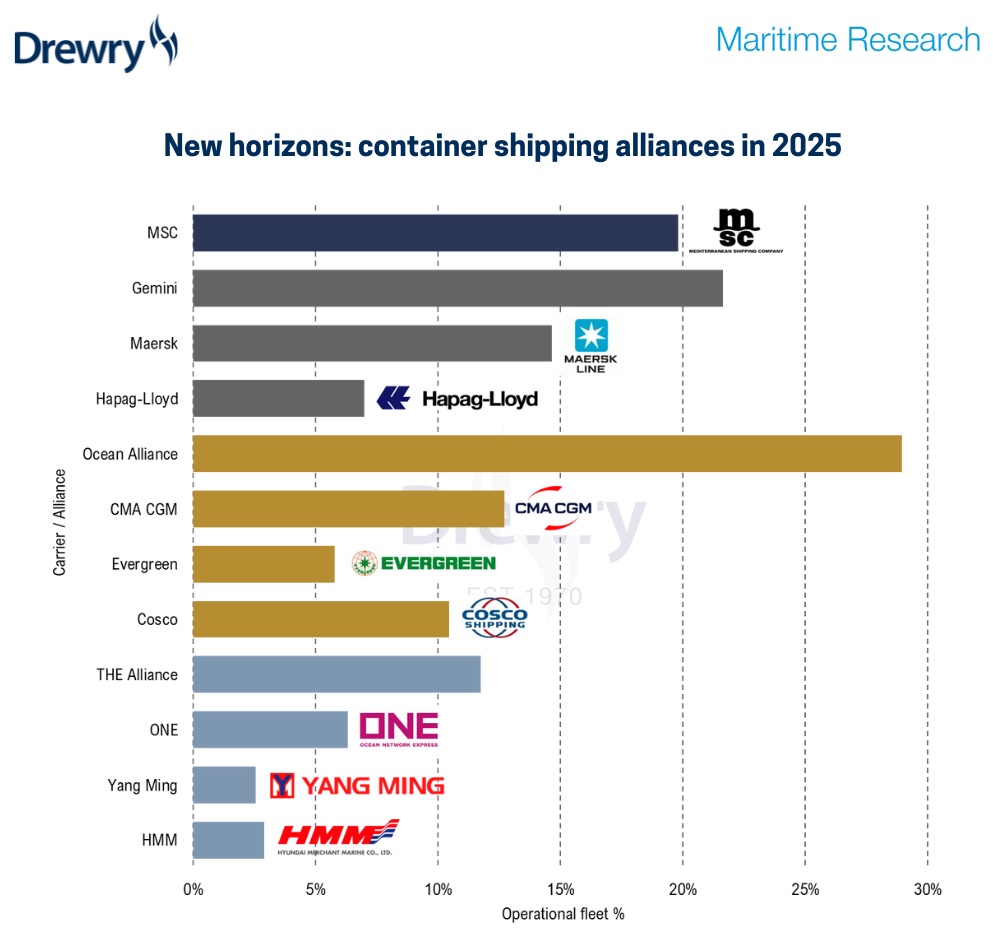

THE Alliance was founded in 2016. Its membership today is made up of Hapag-Lloyd, HMM, Ocean Network Express (ONE) and Yang Ming. THE Alliance is one of three global liner alliances along with 2M and the Ocean Alliance, whose members comprise CMA CGM, Evergreen, and COSCO.

The Gemini partners have stated publicly their intention to get schedule reliability up to 90%, something the two European liners believe will be a significant differentiator with competitors.

Rolf Habben Jansen, CEO of Hapag-Lloyd, said that “insufficient progress” made on reliability was one of the reasons why the German carrier decided to quit THE Alliance.

“This is about bringing schedule reliability to the next level,” Jansen said, adding: “We realised we had to do more on quality and customer satisfaction as well as sustainability.”

Maersk executive vice president Johan Sigsgaard, at a separate media briefing yesterday, told reporters: “We are very certain that reliability is a strong pain point for customers.”

Sigsgaard explained how the new agreement with Hapag-Lloyd – to run for an initial four-year period – has a contract with “financial consequences” if an alliance partner does not live up to its side of the deal when it comes to service quality.

The new cooperation between Hapag-Lloyd and Maersk will comprise a fleet pool of around 290 vessels with a combined capacity of 3.4m teu; Maersk will deploy 60% and Hapag-Lloyd 40%.

The cooperation will comprise 26 mainline services, covering seven trades: Asia / US west coast, Asia / US east coast, Asia / Middle East, Asia / Mediterranean, Asia / North Europe, Middle East – India / Europe and the transatlantic.

Simon Sundboell, founder of liner analytics firm eeSea, commenting via LinkedIn, argued that THE Alliance will not be able to survive without its largest member, Hapag-Lloyd.

“This leaves a large gap in THE Alliance offering, which will by far be the smallest group remaining,” commented Simon Heaney, senior manager of container research at UK consultants, Drewry.

Interesting to read, agrree reliability at 90% would be a marked differentiator, but do liner bheamoths have enough control over the chain to provide this? I for one am keen to see but i’m skeptical… I think there are way too many facotrs beyond the lines control at play here.? (Governemnts, ports, wars, customers, global ewarming… the list goes on)

NYK and Ocean Network Express CEO should bear the full responsibility of this saga for blatantly disregarding schedule reliability. This is well known in the industry that ships operated by ONE performing badly in terms of safety (such as ONE APUS incident) and schedule reliability.