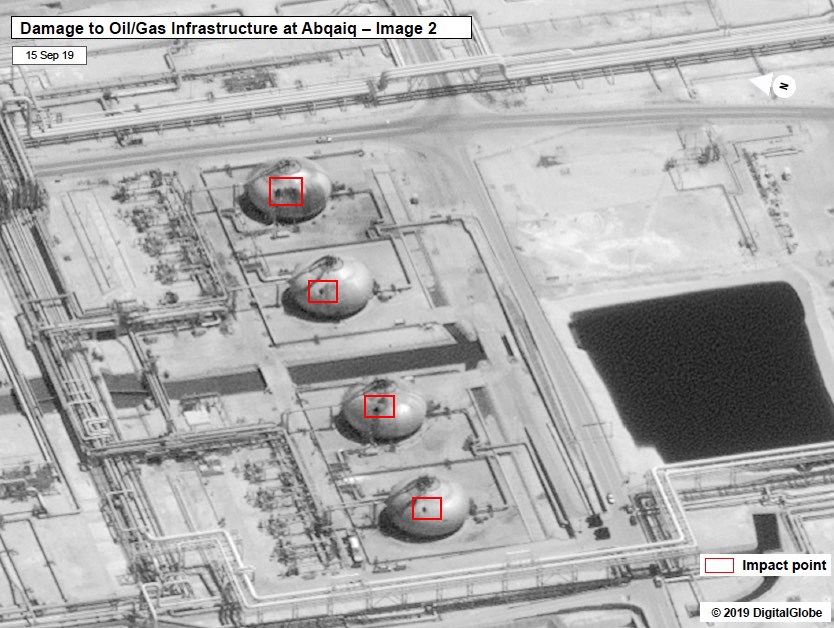

HSFO prices set to leap in wake of Saudi attacks

The attack on Saudi Arabian oil infrastructure over the weekend has shut down around 6m barrels per day of output, equivalent to around 60% of Saudi Arabia’s total output and 6% of total crude oil output worldwide.

Brent prices jumped at the open today, the biggest intra-day surge since trading began in 1988.

Singapore’s Eastport Research & Strategy warned today that the immediate losers in shipping from the attacks could be owners who have invested in scrubbers.

“Surging Brent prices may further add upward pressure to bunker values. Supplies of HSFO have already tightened in many bunkering ports due to the switch from high sulphur to low sulphur grades,” Eastport stated.

Splash understands that in the past week many ports around the world have reported very low levels of available HSFO, with the port of Houston, for instance, unable to meet spot requirements for much of last week.

Oslo-based Cleaves Securities warned oil tanker equities would take a significant hit in trading on Monday with VLCC spot rates and FFAs “likely to tumble”.

The second shipping segment facing significant impact from Saturday’s Saudi strikes are likely to be LPG carriers, which source around 35% of the total demand in terms of tonne-miles from the Middle East. Out of the total Middle East LPG exports of 38.8m tonnes as of 2018, around 55% originated from Saudi Arabia.

Per Magnus Nysveen, head of analysis at Rystad Energy, said the attacks had changed the global oil markets from a situation of unprecedented oversupply risks to a position where it might take a long time to replace the missing barrels.

“This could take a longer time than the authorities initially are claiming. Despite lower exports this year, Saudi Arabia has also depleted its crude oil stocks to the lowest levels in 10 years, so the country alone does not have the same robustness to Middle East interruptions as it used to have. Also, the US cannot quickly replace this volume, as it takes time to relocate oil tankers, and US still has limited export capacity by VLCC,” Nysveen pointed out.

#BREAKING#Iran-backed Houthi militias claim responsibility for a drone attack targeting the world's largest oil field in Buqayq, eastern Saudi Arabia. pic.twitter.com/Jy7UATnTwV

— Heshmat Alavi (@HeshmatAlavi) September 14, 2019