Liner shipping digests the news of the 2M divorce

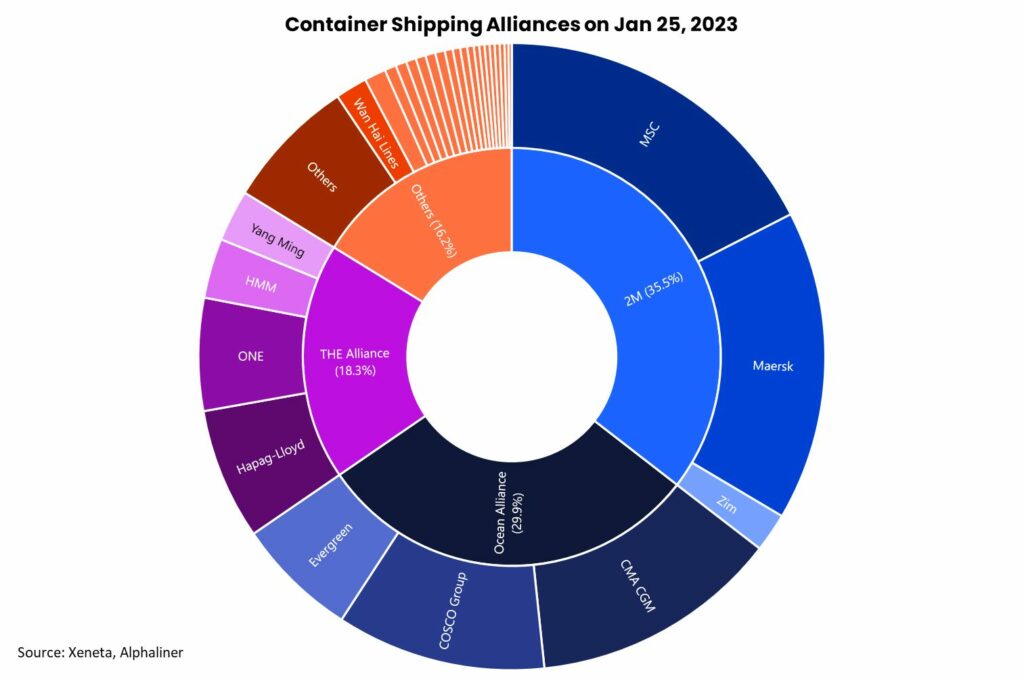

Liner shipping has had 24 hours to digest the “bombshell” news that the world’s two largest containerlines are to dissolve their 2M alliance within the next two years, something that paves the way for enormous changes in the global liner hierarchy.

In a joint statement yesterday, Vincent Clerc, the new CEO of A. P. Moller – Maersk, and Soren Toft, MSC’s CEO, said: “Discontinuing the 2M alliance paves the way for both companies to continue to pursue their individual strategies.”

Hercules Haralambides, professor of maritime economics and logistics at Erasmus University Rotterdam, likened the news to a “bomb in the foundations of the industry” in a post on LinkedIn, a social platform that is rammed full today of conjecture about what will happen to the world’s top liners.

The divorce, due to be completed in January 2025, of container shipping’s “Odd Couple” as one liner veteran described it to Splash had been rumoured for many months, and it will pit Clerc, a Swiss citizen in Copenhagen, against Toft, a Danish former Maersk high-flyer in Geneva, in a battle for customers.

British consultants Drewry have argued that while MSC has the size to go it alone, Maersk could be a in a “tight spot”. There’s a risk too, Drewry suggested, that in order to fill its ships MSC could return to its old market share/low-cost model, which could destabilise the market.

“The Danish mega-carrier is too big to join an existing alliance and too small to go it alone,” Drewry said of Maersk’s predicament in a report yesterday, adding: “It certainly feels like the end of 2M was initiated by MSC, which seems better equipped for independent living than its partner.”

For its part, Maersk has suggested it will seek out vessel sharing agreements to ensure it can continue to offer its broad global range of offerings post-2M. Many experts are predicting there will be plenty more inter-alliance slot charter deals, similar to Hapag-Lloyd’s recent agreement with 2M for Asia to North Europe.

“Alliance membership becomes more difficult to reconcile with far-reaching vertical integration strategies of carriers. Both Maersk and MSC have taken distinctive steps in this direction in the past few years,” commented Theo Notteboom, a professor of port and maritime economics at the University of Antwerp in a post on LinkedIn.

Dr Anil Vitarana, a liner veteran, and now head of US-based Cranford Consulting, suggested regulatory pressure as well as probable scrutiny from antitrust watchdogs, was likely another factor in the decision to end the 10-year 2M partnership.

Commenting via LinkedIn, former Maersk employee, Lars Jensen, who now heads up consultancy Vespucci Maritime, suggested the 2M dissolution is only the beginning of a re-shaping of the alliance constellations on the major east-west trades.

“This will change the competitive dynamics on the major east-west trades for all major carriers, and clearly all carriers will take a close look at which threats and opportunities this will bring forth,” Jensen wrote, saying the joint announcement from Copenhagen and Geneva should be seen as the “first domino” of many to fall over in the next couple of years.