LNG fuel pricing visibility improves

Shipowners keen to keep track of the price of LNG fuel pricing have been heartened by news that S&P Global Platts (Platts) and SEA-LNG, the lobby group for LNG as a marine fuel, are collaborating to improve the price visibility of this increasingly popular shipping fuel.

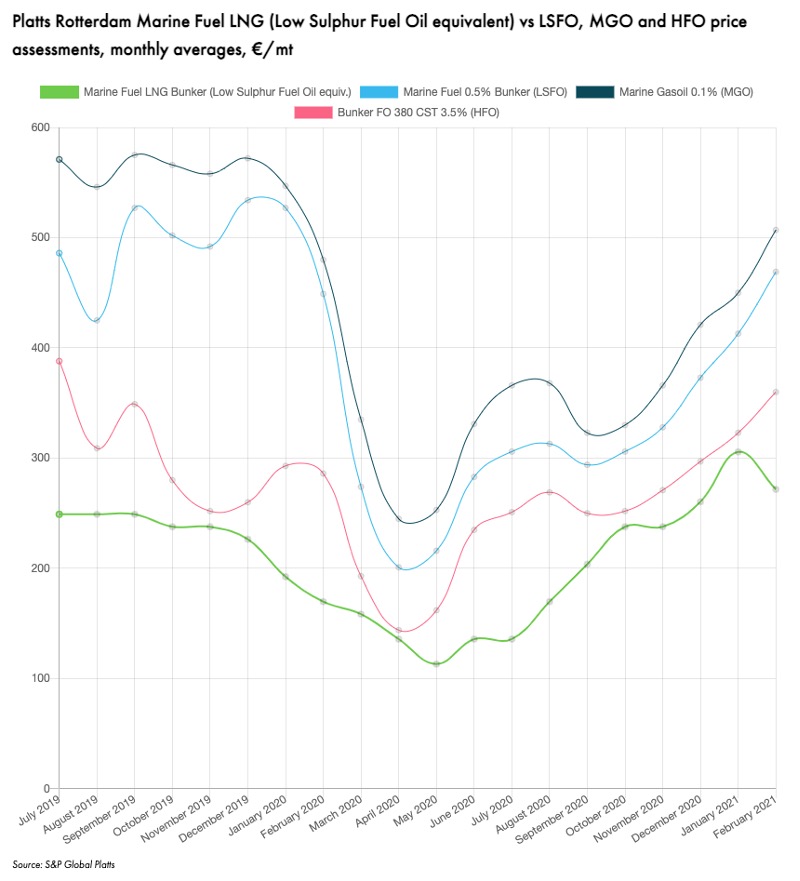

Under the terms of the agreement, SEA-LNG will display monthly averages of Platts’ daily LNG bunker price assessments on its refreshed website, as well as Platts’ fuel oil bunker assessments. By providing greater transparency of trends and comparisons between conventional and LNG marine fuels in the key bunkering hubs of Rotterdam and Singapore, the organisations hope to support operator’s decision making around fuel choices for their fleet.

Kenneth Foo, managing editor, APAC LNG at S&P Global Platts commented: “Platts provided the world’s first daily valuation of LNG bunkers in September 2019. This agreement provides strong validation of the importance of our independent price assessments to markets — allowing shippers and buyers and sellers of LNG to make informed decisions by evaluating Platts’ LNG bunker assessments, alongside the value of traditional marine fuel bunkers on SEA-LNG’s website.”

Latest data from Clarkson Research Services shows 3.5% of the global merchant fleet in gt terms are LNG fuel capable, while a sizeable 26.5% of ships on order today are set to be LNG fuel capable.