Maersk slashes its fleet the most among global carriers this year

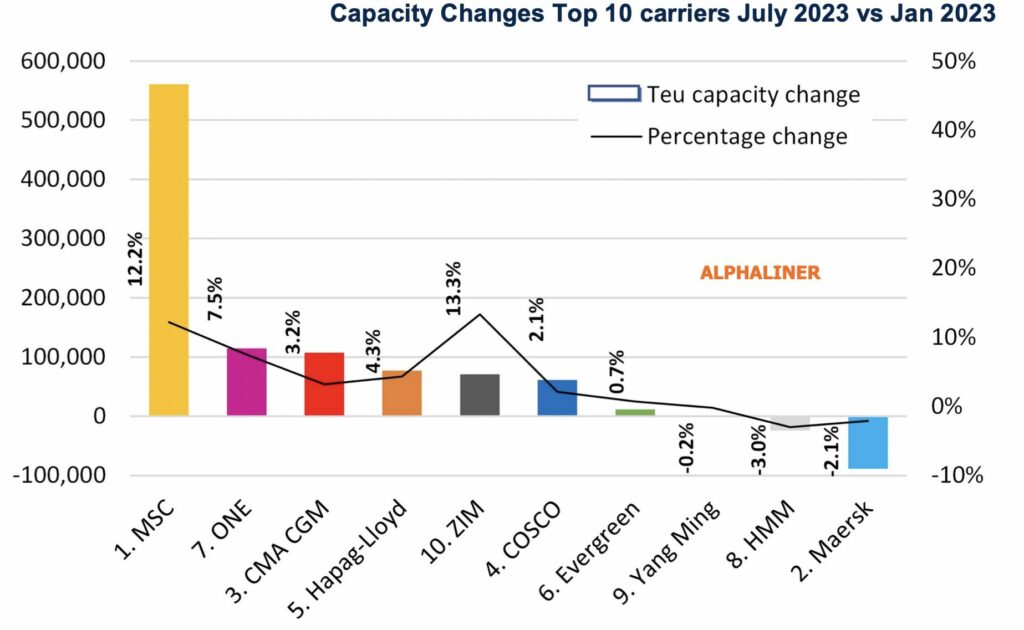

In the year to date Danish giant Maersk has slashed its fleet size more than any other global carrier, according to new data from Alphaliner.

After reducing fleet capacity in 2022 by 1.4%, Maersk continued to sell ships or end charters in the first half of 2023, reducing its capacity again by 2.1%.

Under previous leader Soren Skou, Maersk had stated its aim of retaining a fleet size in the 4m to 4.4m slot range, a policy that his successor Vincent Clerc looks to have continued.

In the last couple of weeks, however, there has been a slight change of tack from Maersk, with Alphaliner reporting a “timid” comeback in the charter markets, fixing six ships in quick succession.

Maersk has spent more money pursuing a goal to become an integrated logistics provider rather than on growing its fleet size, a strategy which saw rival Mediterranean Shipping Co (MSC) surpass it at the top of the liner rankings 19 months ago.

MSC, for its part, continued to be the fastest growing carrier this year, increasing its nominal fleet capacity by 12.2%, adding another 560,200 teu, according to Alphaliner data.

reading, this and seeing all the other carriers do the opposite, one has to ponder – surely they have a good idea what are doing here, surely everyone else is buying boats and capacity when its more expensive than ever before is a bad idea, surely it makes sense to reduce ones fleet size if we’re tipping on the brink of global recession and a trade war (that they may have helped start of facilitate)

but then surely the others also know what they are doing and surely they also have the right idea.

Genius idea or Madness move, whose to know?

For whatever reason, whichever direction the carriers take, you can always bank on the market heading the opposite direction. I have been in the container shipping industry for 3.5 decades and it never ceases to amaze me.

MSC have always worked with a contrary method or even counter cyclically, so their build-up by ordering new vessels and buying secondhand tonnage is seemingly odd, given that the rest of world seems to believe that transportation is facing a global decline. Maybe the Italo-Swiss have a Baldrick-like cunning plan of world domination?

As for all the rest, their situation seems to be a hangover from letting the good times roll and, having ordered new ships when flush with cash, they now have to figure out how to balance their fleets regionally (especially where the new orders are largely of the mega-sized types). CMA-CGM, ONE and Hapag are in this situation, trying to offload older vessels (in the face of a falling scrap market price) but Zim don’t seem to be able to recognise a rising market from a ,falling one – late to order new units and late to re-adjust when the turn comes. COSCO play to a different tune altogether so they do what they are told by the government and Evergreen are also slow to react and last to order new-builds.

Maersk seem seem to have lost interest in ocean shipping and in the space race, with their interest diverted to proving they are greener than all the rest (overlooking the fact that also run Star Air cargo company with 21 gas-guzzling B767s) and that they have ploughed all their energy into land-based activities.