New decarbonisation survey identifies gulf between frontrunners and conservatives

A new survey by the Global Centre for Maritime Decarbonisation (GCMD) and Boston Consulting Group (BCG) shows that most shipowners and operators see decarbonisation as a must, but data shows that major differences appear in their approach and urgency. The same can be said when it comes to adopting green fuels.

To incorporate views from across the industry, GCMD and BCG reached out to a variety of shipowners and operators across vessel types, fleet sizes, and geographies. Some 128 participants across segments were involved in the survey, 25% of which were small companies with under 20 vessels. The respondents collectively own or operate 14,000 merchant vessels, and account for $500bn in revenue.

The new report noted that many shipowners and operators recognize the need to reduce GHG emissions with 73% of respondents viewing getting to net-zero operations as a strategic priority while 77% already have concrete decarbonisation targets, including 54% who have set net-zero targets.

Shipowners and operators are now taking action to meet their sustainability ambitions. Of those inquired, 87% of respondents have personnel working toward green objectives, with 55% having dedicated sustainability teams. A quarter of respondents have also developed clear decarbonisation roadmaps, and respondents are, on average, investing 2% of their revenues in green initiatives.

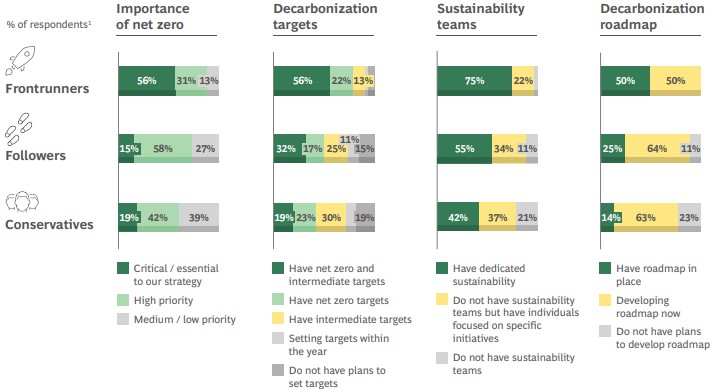

From their answers and data provided, the report split up the participants into three major decarbonisation archetypes – frontrunners, followers, and conservatives.

Frontrunners have the greatest decarbonisation ambitions and have dedicated substantial resources to reducing emissions. They view getting to net-zero operations and half of them put in place clear roadmaps and 75% have dedicated sustainability teams. On average, they are investing 4% of their total revenue in green initiatives, with 74% planning to increase this investment over the next five years. They are willing to invest more to retrofit their vessels with efficiency levers and to pay more for green fuels while 41% are also pricing carbon emissions into their business decisions.

Followers are conscious of the importance of decarbonising their fleets but are opportunistically adopting solutions that unlock immediate value. Some 73% view net zero as a priority, 49% have a net-zero target, and 25% have decarbonisation roadmaps. On average, they allocate 2% of their revenues to green initiatives. They have shorter investment horizons, aiming to recoup their investment 20% faster than frontrunners, and are willing to spend up to $3m per vessel for efficiency retrofits, less than half of the $7m of frontrunners.

Conservatives recognise the need to reduce emissions but have made less progress in adopting decarbonisation solutions than followers. Some 61% view net zero as a priority, with 42% having a net zero target and 14% with decarbonisation roadmaps. Only 42% have dedicated sustainability teams, and on average they invest 1% of their revenues into green initiatives. They face intrinsic challenges, such as low familiarity with available solutions, uncertainty over solutions’ effectiveness, and limited capabilities to assess, evaluate, and implement solutions.

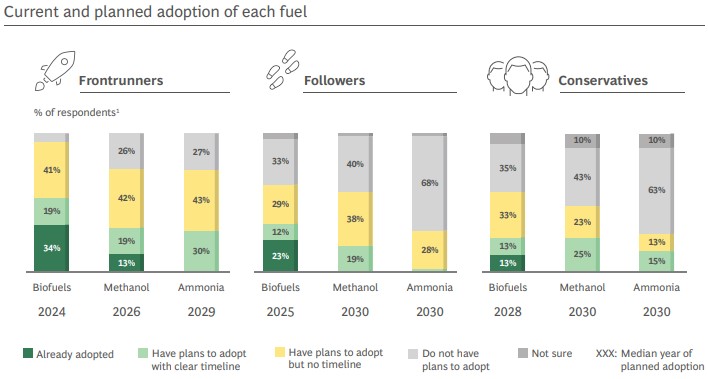

The survey also focused on green fuels – methanol, ammonia, and biofuels – which are expected to form a larger part of shipping’s fuel mix in the medium to long term. Data showed that the three archetypes differed substantially in their outlook on fuels.

Frontrunners see the highest long-term potential in ammonia, likely due to their familiarity with the fuel and confidence in managing its operational challenges and 65% of them perceive ammonia as promising compared to 36% of followers and conservatives. Frontrunners also see ammonia as having higher potential than methanol – unlike followers and conservatives.

Meanwhile, followers are the most optimistic about the long-term potential of biofuels compared to the other archetypes, reflecting their preference for solutions that have been largely de-risked today.

Frontrunners also lead the charge in adopting these fuels, likely driven by their willingness to pilot more nascent solutions and to spend more on reducing emissions. More than 90% of frontrunners have adopted or plan to adopt biofuels, while more than 70% claim the same for methanol and ammonia, and 13% have already adopted methanol.

At the same time, a quarter of followers have started adopting biofuels. Yet compared to frontrunners, fewer followers and conservatives have plans to adopt ammonia (around 30%) versus biofuels and methanol (50%–60%).

Finally, frontrunners’ optimism on future fuels versus other archetypes is also reflected in their adoption timelines. Many plan to adopt methanol in 2026 and ammonia in 2029, while other archetypes are generally less certain.