New liner entrants face pressure from high charter bills

As liner fortunes turn, some carriers are left saddled with very expensive chartered in ships, which could become a drag on profits.

Alphaliner data looking at the top 30 carriers shows Unifeeder and Sea Lead Shipping rely on chartered in tonnage for 100% of their needs, while Emirates Shipping Line has a fleet made up of 96% chartered in vessels, ZIM stands at 94%, with China United Lines (CU Lines) on 87%.

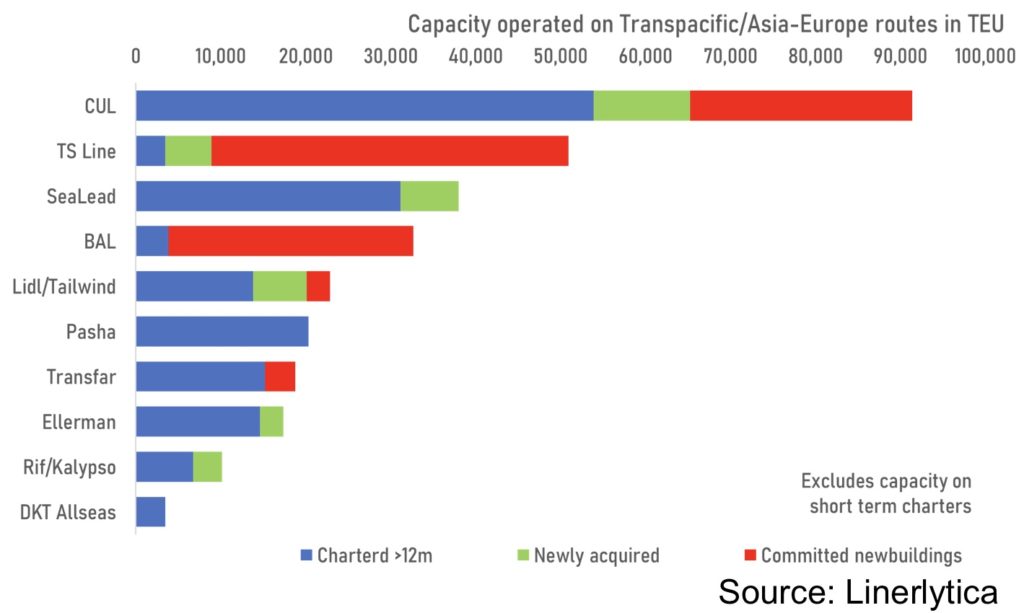

“Several of the new entrants to the Asia-Europe and Transpacific markets have significant tonnage commitments that will not allow them to easily remove their vessels in the short term,” a new report from Linerlytica pointed out.

Looking at today’s stalled charter market, brokers Braemar noted yesterday: “Freight and charter rates continue to slide and the sentiment is uncertain as to when operators, as well as owners, can restore stability to the market and how severe the current market correction will turn out.”

Clarksons Research data shows charter rates have slid 23% from their March peak, but remain more than five times the 2019 average.

Another potential bifurcation in fortunes between carriers is in how liners have focused on spot or long-term contracts.

“As long as contract rates remain intact, the industry is likely to see a widening two-tier market differentiated by those carriers who have signed long-term contracts at elevated rates, and those relying on the softening spot market,” the latest weekly report from Alphaliner predicted.

While there has been plenty of headlines on the swift drop in spot rates, analysts at Sea-Intelligence are forecasting the overall global rate level in full year 2022 will be considerably above full year 2021 levels, and much higher than the pre-pandemic level in full year 2019.

“The carriers must be expected to try to slow the rate decline through more blank sailings, as well as attempting to delay adjustments of existing contracts as much as possible. But ultimately, we are now seeing the adjustment back to normality and it is only a matter of ‘when’ not ‘whether’. And, in all likelihood, the spot rates are likely to undershoot before then coming back up to a new higher normality,” Sea-Intelligence suggested in its latest weekly report.

Interesting article about the new liners entering the different trades. If managed, with a view on adjusted profits, survival can be guaranteed.They will find eager customers in all segments, to shift their cargoes from the big 10.