New milestone for MSC as it readies to surpass Maersk for owned box tonnage

Mediterranean Shipping Co (MSC) is about to achieve another milestone in its rise to the summit of the global container carrier league.

The Soren Toft-led liner is just three ship deliveries away from overhauling rival Maersk as the carrier with the largest owned box fleet in the world.

It was in January 2022 that MSC overhauled Maersk’s quarter-century-long position at the top of the Alphaliner-tracked global liner rankings amid an unprecedented splurge in the secondhand market as well as ordering record volumes of newbuilds. The next three megamax newbuilds to come out of yards in China will see MSC close and ease past the current 66,000 slot gap it has with Maersk in terms of owned tonnage, as well as stretch its overall lead with the Danish carrier to more than 1m teu. MSC also continues to populate S&P broking reports, being linked to four more secondhand ships in the last fortnight.

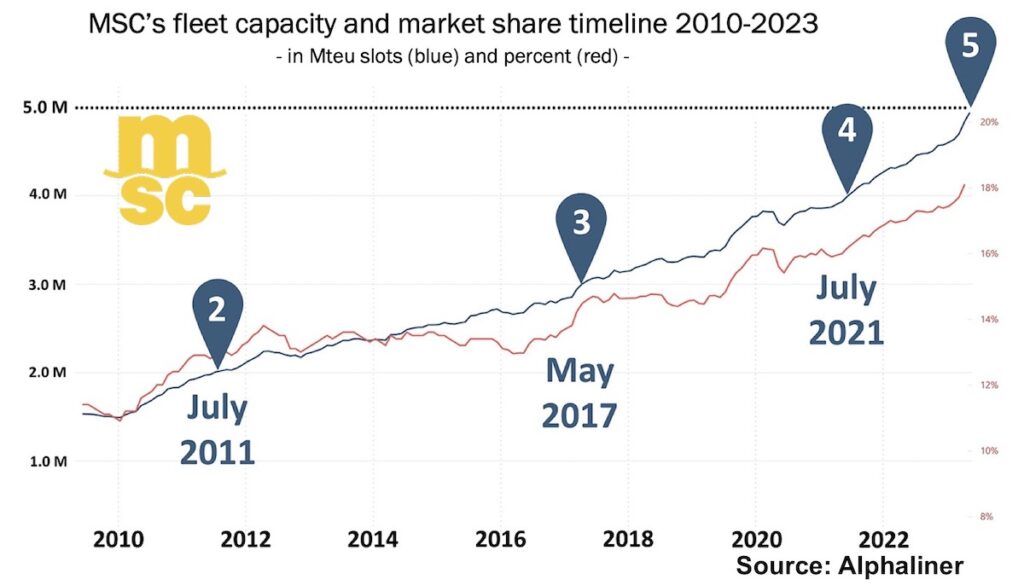

Last month MSC became the first liner firm in the world to operate a fleet in excess of 5m teu. Putting the landmark figure in perspective, the entire global container shipping capacity stood at 5m at the turn of the millennium.

MSC has now doubled its fleet size in just eight and a half years, and a glance at its record-breaking orderbook suggests its fleet could surpass 6m slots by the middle of next year.

Commenting on the fleet build-up, Peter Sand, chief analyst at freight rate platform Xeneta, said MSC’s decision to go it alone once its vessel-sharing agreement with Maersk comes to an end in January 2025 has been central to its vessel acquisition strategy.

“With such scale, you choose your trade lanes with great care, and then you start to dominate the market,” Sand told Splash last month.

Looking at next week’s crunch green talks at the Marine Environment Protection Committee (MEPC) gathering at the International Maritime Organization (IMO) as well as the pressure of the Carbon Intensity Indicator (CII), Andy Lane, a liner consultant, questioned MSC’s fleet build-up strategy.

“CII requirements and potential carbon tax initiatives might change dramatically how an optimal fleet composition will need to look in the future. These factors will dictate how effectively ships can be deployed in the future, and will in all probability result in huge operating, – and/or retrofit – costs. Having more might then not be experienced as a virtue,” said Lane, who heads up CTI Consultancy in Singapore.

Estimates from Danish consultancy Sea Intelligence suggest Geneva-based MSC’s liner division made a 2022 EBIT of $36bn last year.

Gianluigi Aponte, MSC’s founder, and his family are reportedly three times as wealthy as the second-placed family in the latest rich list compiled by local media in Switzerland.

In addition to its cargo division, MSC is the world’s third largest cruiseline.