New value chain analysis from ABS clarifies the future fuels debate

American class society ABS has published a 76-page lifecycle, or value chain, analysis of the greenhouse gas (GHG) footprint of the leading alternative marine fuels, a publication that will likely send shudders among LNG fuel lobbyists.

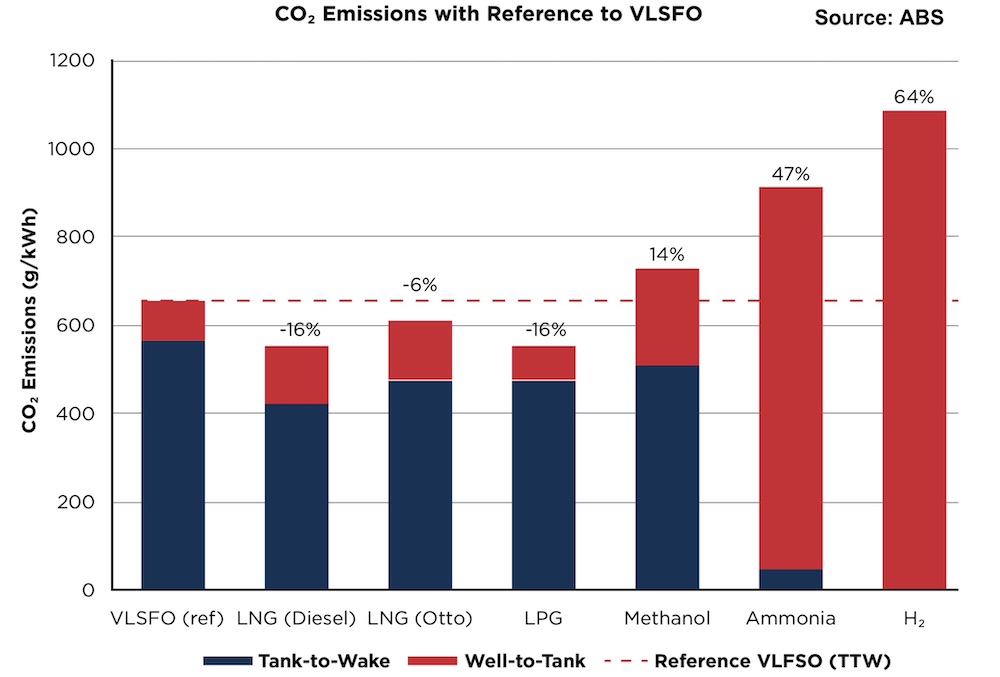

The ABS publication contains prospective technical and economic data on all the most talked about alternative shipping fuels including revealing tank-to-wake and well-to-wake CO2 emission comparisons (see chart below).

ABS also collaborated with Herbert Engineering to explore the feasibility of transitioning from three conventional vessel designs to low carbon variants.

Shipowners’ industry partners are encouraging them to intensify their focus on the entire value chain, not just the combustion cycle

“The shipowners’ strategic industry partners are encouraging them to intensify their focus on the entire value chain — not just the combustion cycle — when deciding which measures to take to reduce their collective carbon footprint,” the report states, adding: “Financiers and charterers increasingly appear poised to set the requirements for the environmental performance of vessels in connection with the prospective financing of new ships and new chartering agreements, respectively.”

The main conclusions of the study of future transition designs are that modern engine developments have made conversion to most future fuels much easier to achieve than in the past. The latest electronic-controlled, two-stroke, high-pressure diesel engines are simpler to convert to alternative fuels without loss of power.

Transition to alternative fuels can be made much more attractive if it is planned at the newbuilding design stage, the ABS report states. In particular, fuel tanks should be specified based on the original and future fuels planned to be used.

The capex of the transition to alternative fuels is largely independent of the fuel, ABS researchers have concluded.

Richard Gilmore, executive vice president at Greece’s Maran Gas Maritime, described the latest ABS outlook as a “must read for all shipping executives”.

“Shipowners need to be conscious of using the lessons from the transition to decarbonisation to build a cycle of continuous process improvement. They can do this by understanding the impact of decarbonisation on all aspects of their business and using that information to power the cycle,” commented Christopher Wiernicki, ABS chairman, on the publication of the latest in its series of decarbonisation guides.

The report points strongly towards ammonia and hydrogen as the fuels with the potential to properly decarbonise the shipping industry.

On LNG, the report’s authors noted: “Although LNG is a low-carbon fuel that can reduce tank-to-wake emissions by about 20 percent compared to fuel oil, it is important to account for its well-to-wake carbon footprint and the contribution of methane to the GHG effect, through methane slip of fugitive emissions. Both of these factors are important and can lead to up to 80 percent higher GHG emissions that marine gas oil (MGO) on a life-cycle basis, depending on the power generation system used.”

Methane slip is only a fraction of the methane emitted to the atmosphere across the LNG production, distribution, and bunkering chain. The United States Environmental Protection Agency (EPA) estimates methane emissions from US natural gas production to be approximately 1.4% of the gross gas produced; however, according to the ABS study, recent studies have demonstrated that this value may be underestimated by as much as 60%.

“These factors create the need to account for well-to-wake emissions of all fuels used in shipping, which is expected to make LNG a transition fuel but not a long-term solution,” the report, entitled View of the Value Chain, states.

“View of the Value Chain is a response to how shipowners’ strategic industry partners are encouraging them to intensify their focus on the entire value chain, not just the combustion cycle, when deciding which measures to take to reduce their collective carbon footprint. Meanwhile financiers and charterers increasingly appear poised to set the requirements for the environmental performance of vessels in connection with the financing of new ships and new chartering agreements,” said Georgios Plevrakis, ABS director of global sustainability. “Reducing the output of carbon emissions will play a key role in shaping the future of the business and how environmental and financial performances are assessed, from individual shipping assets, to fleets and finally to the entire value chain that supports them.”

Splash readers can access the full report by clicking here.

This is a crackin’ report full of much-needed sensible and actionable analyses.