International shipping association BIMCO has said that if the oil product tanker demolition continues at the current pace it will reach an 11-year high in 2021.

The total amount of demolished capacity in the first four months of 2021 has already reached 2019 and 2020 levels due to unfavourable freight rates.

During the years of 2019 and 2020, 1.2m dwt of oil product tanker capacity was all that was demolished per year. In 2021 however, the same amount of tonnage has been sold to cash buyers within just four months for subsequent breaking.

“Demolition of oil product tankers is heading for an 11-year high if the current pace continues for the rest of the year,” said Peter Sand, BIMCO’s chief shipping analyst.

This would then amount to 2.1% of the active oil product tanker fleet.

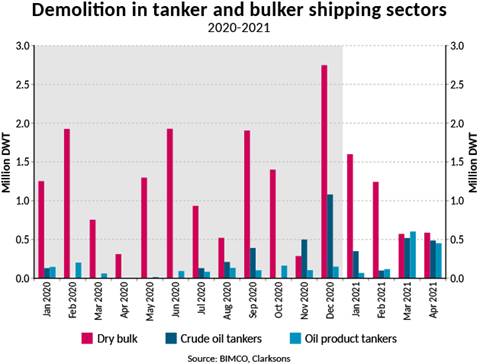

So far this year, 10 crude oil and 38 oil product tankers have left the active trading fleet and the development in crude oil tanker demolition and that of oil product tankers continues to head in different directions. Crude oil cargo carrying capacity of just 1.45m dwt has left the market since the start of the year compared to 1.25m dwt of oil product tankers.

“Oil tanker owners made a lot of money during the boom-periods of 2019 and 2020. No one is short on cash and find themselves actively seeking asset liquidations,” said Sand.

“Just as every crisis holds recognisable elements from previous one – they are never the same. Every one of them contains something unique. This time around it seems to be demolition of oil product tankers that stand out,” Sand asserted.

With low earnings in the spot market most likely to stick around for longer than anyone hopes for, demolished crude oil tanker capacity during 2021 will no doubt exceed that of 2020 and 2019 (2.2m dwt). But BIMCO believes it is unlikely to reach the 18.5m dwt that faced the blowtorch in 2018 as earnings were multi-decade low.

Compared to tankers, BIMCO said that demo of dry bulk capacity has been the exact opposite. Going into the year, bulker owners did not expect the extraordinary market that the first four months of the year has turned out to be.

The average age of bulkers leaving in 2020 and 2021 is 28-29 years, illustrating that owner are pleased with current market condition and no one is selling young ships for demolition.