One in five VLCCs hit by sanctions

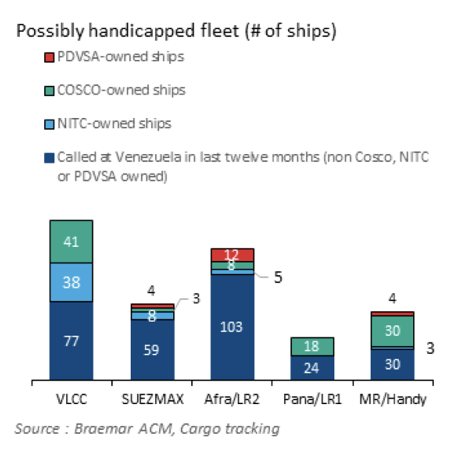

One in five VLCCs in operation today face restrictions from US sanctions, according to data from Braemar ACM. Research carried out by the shipbroking house also shows that just over a sixth of the world’s suezmax fleet and 10% of the aframax/LR2 fleet face similar trading restrictions from Washington, something that has sparked the greatest rally in tanker fortunes ever over the past week with VLCCs cruising past the $300,000 a day mark on Friday.

The recent sanctions have been levied against a pair of Chinese tanker operators as well as tankers with links to Venezuela. Iranian tankers have also had sanctions in place for many months.

“Is this Dutch tulips or bitcoin all over again? Probably. But let’s enjoy it as long as it lasts,” Braemar ACM suggested.

Cleaves Securities mused in a weekly report published yesterday: “How long current spot rates will last is mainly in the hands of politicians, but we are still optimistic on the fundamentals: The orderbook is at its lowest level since 1997, US exports continue to surge & the IMO’20 sulphur regulations should positively impact the market balance in a myriad of different ways.” Cleaves has predicted VLCC prices could rise 50% over the next two years.

New York-based tanker brokers Poten & Partners suggested the current market was likely to remain robust.

“History also teaches us that earnings can come down as quickly as they go up. However, the major impact of IMO 2020 is still coming and there is no significant new shipping capacity in the pipeline. While there are almost 800 VLCCs in the world, tanker rates are driven by the modern vessels in the spot market, which is less than 50% of the total fleet. We expect that the market will remain robust, albeit volatile,” Poten pointed out.