Panama Canal latest: how each shipping segment is being impacted

Vessels in queue for transit across the Panama Canal stand at 128 ships today, some 42% above the 90 average, but 21% below the figure a month ago.

While containerships, which have fixed schedules, tend to have reserved slots, the voyage plans for the tramp trades continue to be hit hard by the ongoing congestion brought about by drought and subsequent draft and transit restrictions put in place by the Panama Canal Authority (ACP).

Ships desperate to get to their destinations have been forking out record sums to barge past the armada of merchant ships at both ends of the waterway.

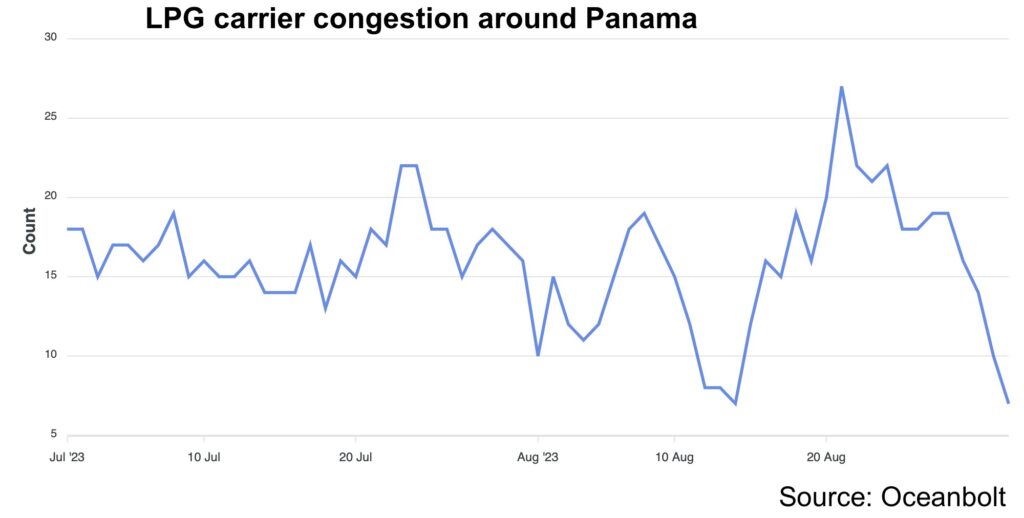

“You can skip the queue but it’s immensely costly,” said Oystein Kalleklev, Avance Gas’s CEO at an earnings call earlier this week. “It’s gone rapidly up. When you add the regular fee you’re getting close to $3m to get your ships through.”

The ship in question – an LPG carrier – paid $2.4m in addition to a standard transit fee of around $400,000.

In a sign that the authorities are confident that the worst of the congestion has passed, the ACP has decided to rescind booking condition 3 for its panamax locks, moving back to a more regular booking condition 1.a as of this Sunday. Nevertheless, shipping is having to contend with the fact that draft and transit restrictions are here to stay at least through until the end of the first half of next year.

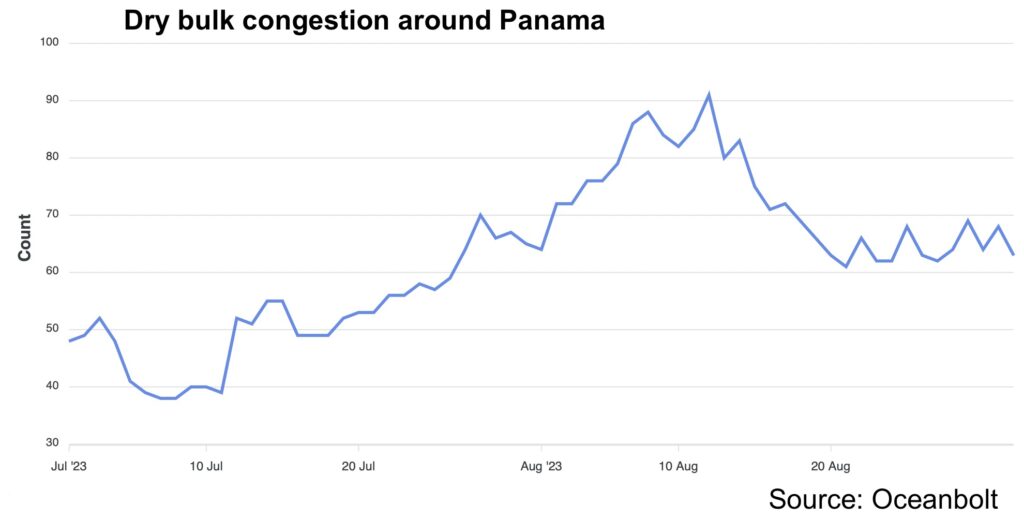

For dry bulk, which has been acutely effected by the restrictions, the 10 months of transit restrictions announced by the ACP last week could have a larger effect on dry bulk trade flows, tonne-miles and the competitiveness of the region’s exporters.

While the impact is baked-in to voyage costs for ships already in the queue, Thomas Zaidman, managing director of Sagitta Marine, a handy and supra operator, warned that a handysize vessel owner is still looking at a $160,000 lump sum for a 10-day wait at the canal. A vessel of around 55,000 dwt would be looking at an additional $220,000 lump sum payment, he calculated.

In future, cargoes that regularly cross the canal could find themselves fighting to remain profitable as buyers look to more distant markets that would have lower overall costs, despite a higher tonne-mile ratio, he predicted.

“The situation in the Panama Canal has both immediate and long-term consequences. Price inflation is an issue, but the reality is that, as owners ask for higher rates to price in the additional costs of delays, it may change the origin point for some cargoes,” Zaidman told Splash.

“While this vital shortcut is an enabler of trade, it will remain a chokepoint for global shipping not only because of weather-related incidents like El Nino, or more regular but still large swings in the Lake Gatun water level – also because of the unlikeliness of alternatives coming about,” warned Peter Sand, chief analyst at Xeneta, a container freight rate platform.

“While we cannot rule it out, and Chinese investors regularly pour money and attention into it, the building of a Nicaragua canal or a Columbian dry canal cannot step in as an insurance against supply chain disruptions centered around the Panama Canal,” Sand said.

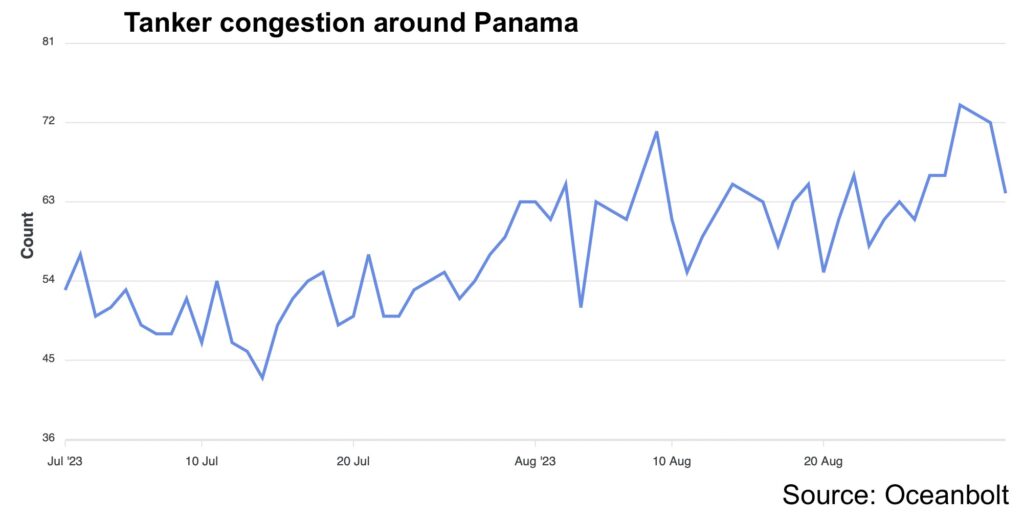

The current drought in Panama has driven an increase in the number of MR tankers waiting to transit the canal, according to data from Vortexa, a commodities tracking platform. This increase is mainly driven by laden vessels heading southbound towards South America’s west coast.

This has kept vessels occupied for longer periods of time and limited vessel supply in the US Gulf. This is supporting MR freight rates in the Atlantic basin, along with increased utilisation in the long-haul trade.

Looking ahead, Vortexa analysts predict tanker supply could be limited further as MRs discharging after taking cargoes via the Panama canal are ballasting decreasingly towards the US Gulf and the Caribbean. This change in tanker behaviour could further support Atlantic basin MR rates and vice-versa exert pressure in the Pacific.

You call that a Panama Canal delay?

I had a ship at either end of the canal when Ronnie Rayguns invaded the place, incidentally shooting up our Agents’ (Fernies) offices in the process !