Pitfalls linked to index deals

Anders Liengaard from Danish consultants Liengaard & Roschmann has some words of caution for the increasingly trend of index-linked deals in dry bulk.

Some 20 years ago index-linked deals would be synonymous with young London shipbrokers with spiky hair and fast cars. It didn’t get much attention back then, but with today’s activity it is worthwhile looking into a pitfall overlooked by most players in the industry.

There can be many reasons for entering an index-linked deal. Below are listed a few:

- Obtaining critical mass without taking on extra risk.

- Operational flexibility by having more vessels on the water.

- Operational profits by beating the market.

Professionals in the field can probably add several more reasons.

How does it work?

An index-linked deal works in the way where two parties agree at an index on a specific vessel against the Baltic Exchange Index vessel for the same vessel segment (handysize, supramax, panamax or capesize). The deal covers a certain period very similar to normal period charters. It could be shorter periods (four to six months) up to several years.

The deal is normally settled on agreed terms which usually would be at the end of each month. Very simplified this would mean that a vessel which is on charter at an index of 105 points to the Baltic Index Vessel would be getting $10,500 a day (less commissions) if the Baltic Index for the period was $10,000 a day.

How do you define an index of a ship?

When an index-linked deal is done it requires that an owner and a charterer can agree on a rate or in this case an index. Establishing the index of a given vessel is normally done by systematically testing the vessels earning capabilities such as intake (deadweight), cubic capacity, draft, speed and consumption. This is done by creating voyage calculations that challenge these parameters. In the following example we have used the online independent indexation tool www.vesselindex.com.

However, agreeing on an index and then leaving the contract in the top drawer can result in lost income. There are large sums of money to be lost if you ignore the fact that an index of a vessel is fluctuating.

Index is fluctuating

The index of a vessel changes with the movements in fuel prices and market levels depending on the vessels profile referring to the before mentioned vessel characteristics (deadweight, draft, cubic capacity, speed and consumption). This seems to make sense as it is obvious that a so called ‘eco friendly’ vessel (a vessel that burns less fuel than the average vessel for same segment) will perform relatively better in a market with high fuel costs compared to a similar market with low fuel costs.

This adds to the complexity of index linked deals and in the practical world things tend to get simplified. So, watch out! The complexity may carry a big value if you as owner or charterer is not observant.

The financial impact

Let’s look at an example with a supramax vessel, in this case a 63,000 dwt Imabari-built bulk carrier, which can be characterised as an eco type based on the relatively low fuel consumption.

In today’s market with fuel prices at roughly $370 per metric ton IFO and a general market level for the Baltic Exchange Index vessel (Tess 58) of around $15,000 a day the index of the Imabari vessel, according to Vesselindex.com, comes out at 112.3 points compared with the index 100 benchmark vessel (Tess 58).

In our example we assume that the index deal runs for a year and that the market, one month after having negotiated the deal, falls to levels similar to what was seen earlier this year in February ($420 per metric ton IFO and a market level of $5,000 a day) and remains at this level for the remainder of the contract.

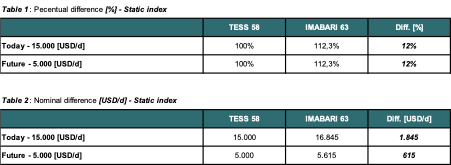

With the contract constructed with a fixed/static index, the elements of income generation are illustrated in table 1 and 2:

On this basis the total one-year period income is (without taking commissions into account):

1-month (31 days) x $15,000 a day x Index 112,3 + 11 months (334 days) x 5,000 x Index 112,3 = $2.40m

However, because of the eco profile of the Imabari vessel, her index against the Baltic benchmark vessel increases in a falling market environment with higher bunker prices. According to Vesselindex.com her index during the ‘depressed market’ is close to 129 points against the Tess 58.

Based on an index deal made today at index 112 the Imabari built vessel will only get $615 a day more than the Baltic benchmark vessel (Tess 58) where she should have obtained around 17% more i.e. $1,450 a day. In other words, a loss of income of some $835 a day.

The solution

The solution to this would be to implement a wording in the contract allowing for adjustments of index over the course of the charter.

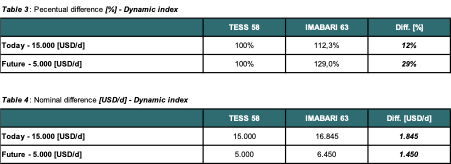

With the contract constructed with a dynamic/moving index, the elements of income generation are illustrated in table 3 and 4:

On this basis the total 1-year period income is:

1-month (31 days) x 15.000 USD/day x index 112,3 + 11-months (334 day) x 5000 USD/day x index 129 = mUSD 2.68

The difference, over the full charter period, between the fixed and dynamic index-model amounts to mUSD 0.28 or equivalent to USD 767/day.

The morale of the story is to take control and know what your upside and downside could be, instead of leaving it as another uncertain point in an already uncertain industry.

Note: Above methodology is also highly relevant for owners participating in pool setups where vessel-specific distribution keys are applied.