Port congestion contagion spreads

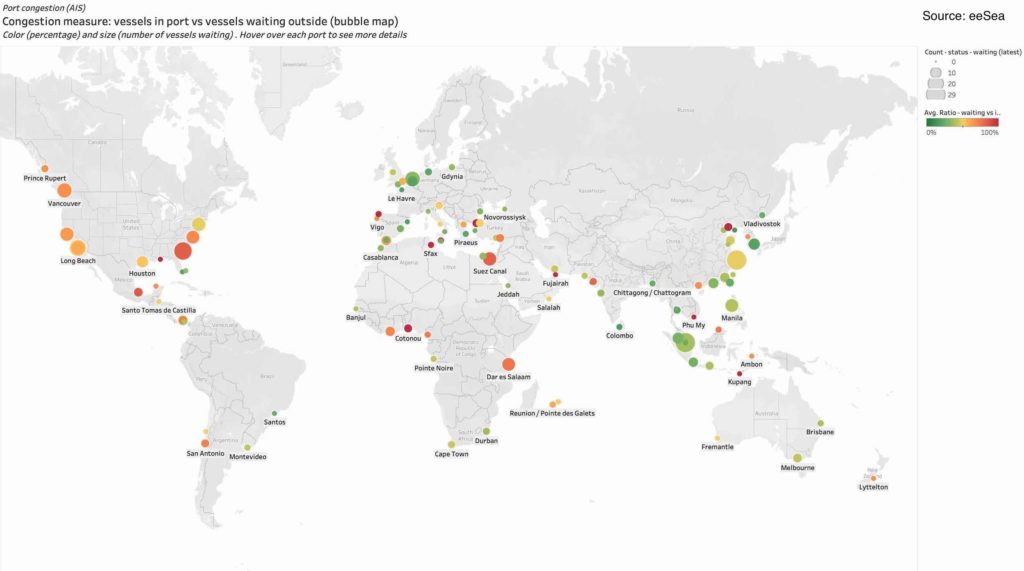

The global nature of the container port congestion saga, which has dogged supply chains during the pandemic, is illustrated clearly today with data from consultancy eeSea.

The Danish firm has sent Splash a map (see below) charting the congestion hotspots around the world, an image that clearly shows boxes are backing up across almost every tradelane, and that the issue is not simply one dominated by North America.

In a customer advisory on its Asia – Mediterranean services yesterday, liner giant Maersk stated: “The unprecedented situation of severe port congestion globally continues to result in accumulation of delays across several services on the Asia to Med network. This situation is driven by a combination of increased demand and measures to fight the pandemic across ports and supply chains in general. These accumulated delays are currently causing further gaps in the schedules and have resulted in several Asia departures been spread apart by more than 7 days.”

Data from Korean liner HMM shows continued high levels of port congestion in both Europe and North America, rendering 12.4% of the global vessel capacity unavailable. Putting this in perspective the normal, pre-pandemic state of affairs in the market is that 2% of global capacity is trapped in delays somewhere.

While most headlines in recent months have focused on the immense boxship queues off Southern California, this picture is changing.

Noting via LinkedIn this morning the fact that the number of ships off Long Beach and Los Angeles has now dropped to 61, down from highs above 100, Lars Jensen, CEO of liner consultancy Vespucci Maritime, pointed out the growing queues on the US east coast and the gulf. Outside Charleston, for instance, new record high levels of 31 vessels were reached on Wednesday leading to a situation of not accepting the gate-in of loaded exports on Thursday and Friday mornings.

“It thus appears that part of the reason for the improvement off California is not that the supply chain problem is being resolved – the problem is merely being shifted elsewhere,” Jensen observed.

The spot rate for a 40-foot container from Shanghai to Los Angeles rose to $11,030 yesterday, up 3.3% from a week ago and 125% higher than a year ago, according to the Drewry World Container Index.

Lyttleton is congested??

Shouldnt that be Auckland?

Half a world away from Bernard- previous commenter, I would note that Charleston SC with 31 ships waiting (per article) has a bigger dot on the map than LA/LB California with 61 vessels (per the article).