Bunker intelligence platform ENGINE has teamed up with price reporting agency and biofuels specialist PRIMA Markets on biofuel-blended bunker fuel benchmark prices. ENGINE is also introducing its Fuel Switch Snapshot, a price tracker of comparable alternative and conventional bunker fuels in the world’s two biggest bunkering hubs.

Biofuels have become considerably more mainstream as bunker fuels in the past year and market participants are looking for ways of benchmarking their buying performance against their peers.

Combining ENGINE’s conventional bunker fuel benchmarks with PRIMA Market’s assessed biofuel benchmarks, and backing them up with stems, generates B24 and B30 benchmarks for Rotterdam, Singapore and Los Angeles. A series of eight bio-bunker benchmark prices have been launched.

PRIMA Markets director Matthew Stone said: “The marine market is the latest entrant to the booming renewables space. PRIMA Markets provides the data, information frameworks and deep understanding of the market from feedstocks to renewable fuels to allow firms to execute successful strategies in renewables.”

Despite the EU Emissions Trading System’s (EU ETS) tax on carbon, burning HSFO, VLSFO or LSMGO and paying for the CO2 they emit still pays off when bio-blended alternatives are priced as high as they are today.

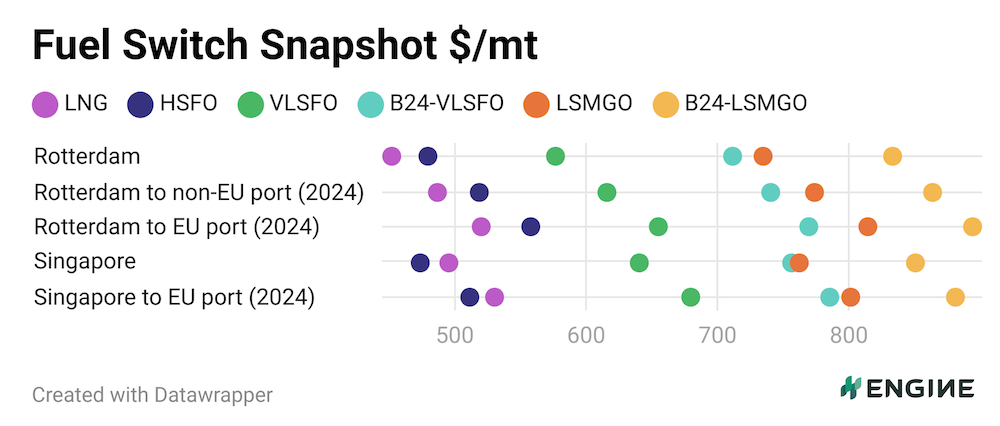

ENGINE’s new weekly Fuel Switch Snapshot provides an apples-to-apples comparison of bunker fuels on the market, so buyers can consider not only the outright price of the fuels, but also how far their ships can sail on them and what they will pay to burn them on EU-linked voyages.

Once a week, ENGINE will publish a snapshot of alternative and conventional bunker fuel prices in the world’s two biggest bunkering hubs. The prices will come adjusted for calorific contents – the bang for your buck – and with costs of emitting CO2 in the EU both included and excluded.

The first edition makes the case that low-priced LNG is the obvious choice for most dual-fuel ships today.

In the chart below dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various levels of EU ETS costs excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port).

All the prices in the chart above are adjusted for calorific contents, meaning that the same weight of fuel in metric tonnes will theoretically allow a ship to sail the same distance because they contain equal amounts of energy.