Ports and LogisticsTech

RightShip launches ports taskforce

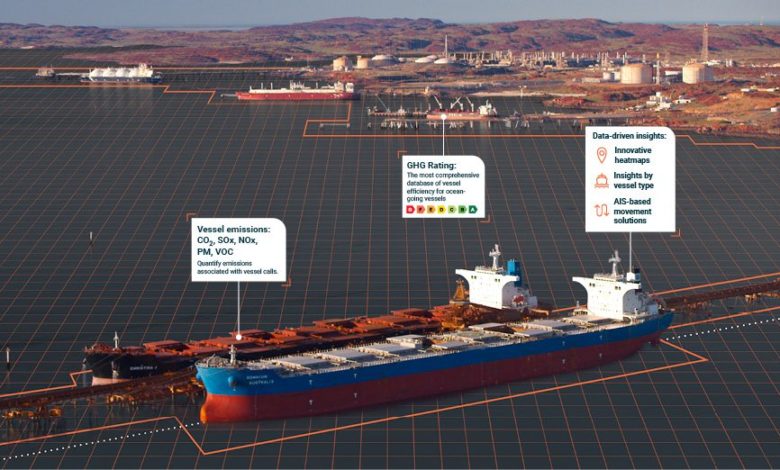

Melbourne-based vetting giant RightShip has launched RightPORT, a ports and terminals taskforce covering ESG, safety, sustainability, and crew welfare issues worldwide

Yucel Yildiz, ports and terminals manager at RightShip, said: “RightShip’s ambition is a zero-harm maritime industry. With more than 40 ports already taking advantage of the ESG solutions provided by RightShip, this announcement formalises our commitment to extend data-led solutions to the breadth of the industry. Ports and terminals are the critical points that connect the maritime world with onshore economies and communities – and that concentrate marine activity in contained areas.”

THE NEW BUSINESS MARKETING OF THE BLUR VISION OF RS ON SEAPORT DATA AND THE ESG CONCEPT.

So, RightShip is a newcomer in Seaports aiming at an ESG new business line for its aspirations to gain ESG market share revenues. This follows a deficient, or scorned “ship vetting portfolio” of a renewable scheme of “tick lists” for pen-pushers paperwork, and “blind inspections”, ever-customized by its client’s opinions when comparing “apples” with “bananas”…

Now, expanding to “Zero-harm” for Sea Ports RS offers “harmless” but maybe costly “consultancy on ESG KPIs and ratings by extending again an “apples-to-bananas” concept to Sea Ports that are a fundamentally different business, requiring customized KPIs and weighting from any other ESG subject.

It’s time for investing and operating entities to open a wide eye and watch closely those “consulting” and “rating” business fishing in the murky waters of unregulated ESG KPIs and ratings which compete with each other. How “accurate” are they to represent a financial and operational risk?

Look at the “intentional divergence of ratings” which demonstrates the lack of data veracity and standardization of methodologies of data collection, data qualification, and analysis in producing “scores”. Look at the secretive “methodologies”, under a general lack of transparency and disclosure and the needed oversight.

Those facts and variations can only blur investors’ understanding of sustainability and performance risks at both equity and portfolio levels. And RS is another consultant of flattering ESG ratings which ignore the real indicators of risk and trouble ahead of convenient rating signals. The history of financial reporting is an indication for investors who don’t hold their breath for reading ESG stories on pay.