Further signs are emerging of how sanctions combined with Ukrainian drones are causing serious problems for the Russian oil exporting machine with advice issued today on how Washington could reduce the size of the so-called shadow fleet further.

Research carried out by Craig Kennedy, who runs the Navigating Russia substack, suggests the shadow fleet is in crisis.

“Beset by mixed economics and perilous sanctions, shadow fleet growth has stalled,” Kennedy argued, adding: “The Office of Foreign Assets Control (OFAC) is well positioned to downsize the fleet and undercut Moscow’s main price-cap evasion strategy should it choose.”

In the first year following the full-scale invasion of Ukraine by Russia, Moscow invested in a huge swathe of vintage tonnage, but this fleet build-up has since stopped growing.

Shadow fleet expansion began to decelerate sharply in mid-2023, according to new analysis by Kennedy, a former vice chairman at a global investment bank, who is currently writing a history of the Russian oil industry and its impact on civil society.

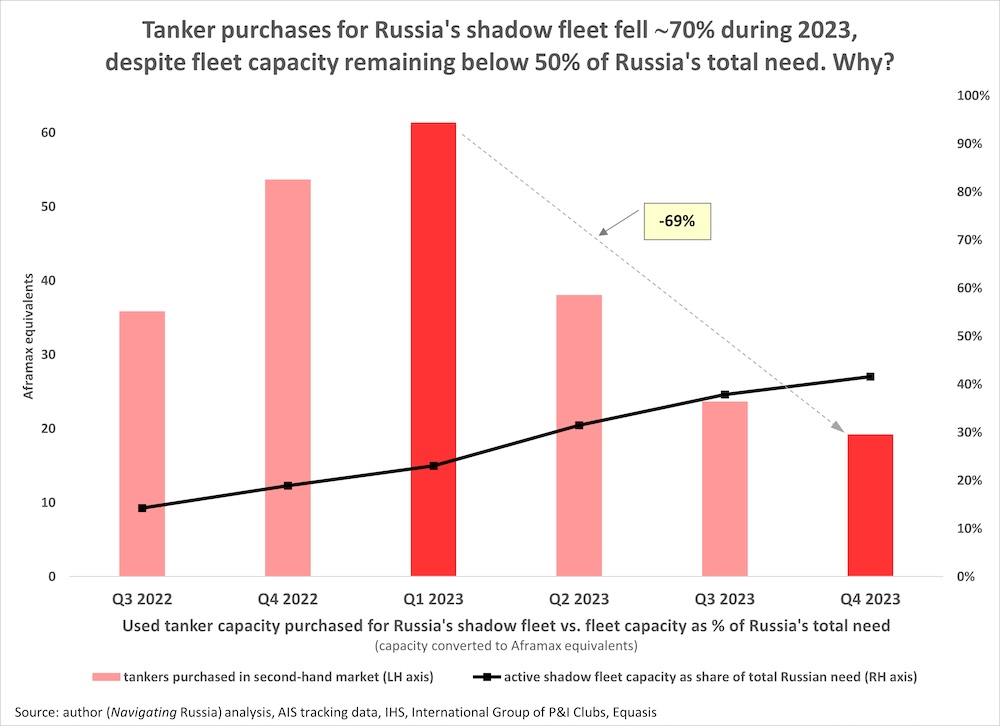

The tanker turnaround began in Q2 last year, when the number of tankers bought quarterly for Russia’s shadow fleet dropped off sharply, following three quarters of aggressive expansion. By Q4, purchases were down some 70% off Q1 highs.

Analysis by Kennedy claims that the Russian shadow fleet capacity remains below 50% of what Russia needs for a standalone fleet.

“Fleet expansion has been costly,” Kennedy wrote in a new report issued today. “An estimated $8.5 billion—largely financed by the Russian state it appears—has been spent acquiring aging vessels at record prices, most with only 2 to 3 years of expected service life remaining.”

Growth was further impeded last October when OFAC launched an effective campaign of measured tanker blockings. To date, 40 vessels representing some 15% of fleet capacity have been blocked according to Kennedy.

There has also been recent reports of major Indian importers refusing any deliveries on Sovcomflot tankers, which account for up to 25% of shadow fleet capacity, for fear of what has been described as “sanctions contagion”.

The fate of the fleet, Kennedy argued today, depends largely on OFAC’s next step—specifically, on whether it continues to block more tankers and at what pace.

“If OFAC acts to downsize the fleet, it would expose more revenues to price cap restrictions and incentivize Moscow to pursue a volume-over-value export policy,” Kennedy argued.

NATO reported last week that some 15% of Russian refining capacity had been taken offline by repeated Ukrainian drone strikes.

Analysis carried by Vortexa last week showed Russian clean products at sea have recently risen to new record highs.

“It looks increasingly likely that Russia is struggling to administer all logistics, including payment,” analysts at Vortexa, a freight data platform, suggested.

Several banks in China, the UAE and Turkey have hiked their sanctions compliance requirements in recent weeks, resulting in delays of up to months or even the rejection of money transfers to Moscow.

Grey tankers, as broker BRS describes the shadow ships, will have great difficulties returning to normal trading. Not only because they are among the oldest in the global tanker fleet, but also because their maintenance has often been questionable.

“Furthermore,” BRS stated in a recent report, “they will remain flagged by the insurance, banking, and services communities as ‘delicate’ units to work with (whether sanctions are lifted or not).”

The number of similar articles looks as self-hypnosis. The west needs any even small victory in the sanction war.

Anyway, it is good for Russia to save their own oil and turn to local consumption and manufacturing. Russia still has significant foreign trade surplus.

Is that you again Vlad?

I missed you, David, under the British shipyard to close article.

Glad that not only me noticed it: daily articles on same theme with same starting and ending points. One more today… Boring.