Shipping in the Year of the Dragon: Containers

The Year of the Dragon, the most auspicious of animals in the Chinese zodiac, is upon us. What does the following year have in store for shipping’s fortunes? Maritime CEO is back with a unique annual outlook looking at the prospects for the main shipping sectors, as well as having deep dives into the Chinese economy, ship finance and shipmanagement. The data-packed magazine also features in-depth looks at what maritime can expect in terms of green and digital tech with more than 300 of the industry’s most famous names polled to create an incisive, must read for shipping’s c-suite making big investment decisions over the coming 12 months. Kicking off this week’s coverage of the magazine, we turn to the container sector.

The Houthis have saved container shipping’s bottom line for now. In what was supposed to be an annus horribilis for container shipping with more than one newbuild delivering each and every day in 2024, the overcapacity spectre has been shelved thanks to the Red Sea shut-in.

No sector reacted faster – and more en masse – than container shipping when the Red Sea shipping crisis exploded with some 90% of all tonnage on the Asia-Europe tradelane rapidly redeployed to take the longer route around southern Africa.

Clarksons Securities believes continuing Red Sea disruption could be a “game-changer” for container shipping in terms of newbuilding deployment.

With the average haul length jumping by 9%, Clarksons stated: “If this trend continues, it has the potential to absorb all newbuilds scheduled for delivery in 2024, which would be a game-changer for the industry.”

The Red Sea crisis sent ocean freight rates through the roof to highs not seen in history bar the pandemic years. However, there are already signs that a plateau has been passed.

Some semblance of order has been restored

Emily Stausbøll, a market analyst with Xeneta, comments: “Unlike during covid-19 when disruption continued to wreak havoc, shippers and carriers now know what they are dealing with in terms of ships being diverted around Africa to avoid the Suez Canal. Rates are still elevated so the impact of this crisis is far from over – and the situation can still change at any moment – but perhaps some semblance of order has been restored.”

The Houthi attacks on Red Sea shipping could easily prove transitory, something Maersk touched upon at its full-year earnings issued in February in which the Danish carrier suggested freight rates will revert to pre-disruption levels as record new-vessel deliveries make their way into service even if the Red Sea problems persist for the whole year.

Avoiding the Red Sea probably absorbs an additional 5% of global shipping capacity, more or less, according to HSBC.

However, it’s important to bear in mind utilisation was hovering around 70% last year, according to estimates from DNB Markets. That is well below levels in recent years which have consistently been over 80%.

Maersk expects global container volumes to grow 2.5%-4.5% in 2024. But new container shipping equal to about 11% of the current fleet will enter the seas, according to DNB.

Maersk chief executive Vincent Clerc said that eventually the oversupply in shipping capacity will lead to price pressure and affect the firm’s results.

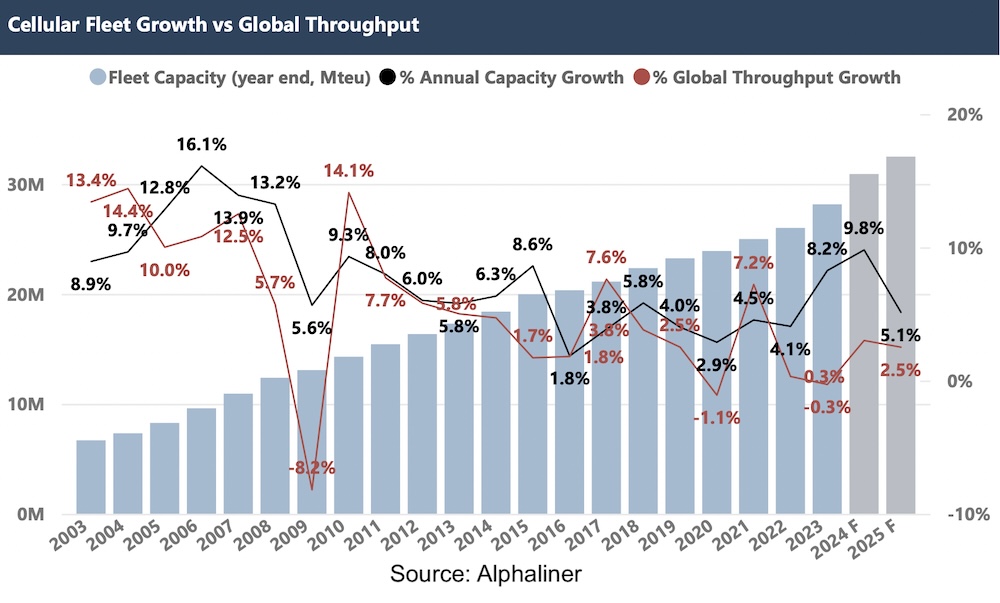

The container fleet capacity is expected to grow by 10% in 2024

Maersk downplayed the impact of events in the Middle East: despite the boost from the crisis in the Red Sea, around twice as many new vessels were being delivered to the market compared to the extra capacity required to send ships around Africa.

In 2023, shipyards delivered 350 new containerships with a total capacity of 2.2m teu, beating the previous record from 2015 when 1.7m teu was delivered. The 2023 record is now likely to be soundly beaten this year.

“Although owners, as well as the liner operators, are currently benefiting from the irregular events in the market out of the Red Sea as well as the Panama Canal, then it may be prudent to remember the 3.1m teu in extra capacity that is expected to deliver in 2024, with around 140 vessels due in the first quarter,” analysts at brokers Braemar noted, a topic which has subsequently been picked up by Niels Rasmussen, chief shipping analyst at BIMCO.

“In 2024, 478 container ships with a capacity of 3.1m teu are scheduled for delivery, beating the 2023 record by 41%. The container fleet capacity is therefore expected to grow by 10% in 2024,” said Rasmussen. Extrapolating the BIMCO data shows 1.31 boxship newbuilds are delivering each day, every day this year.

BIMCO expects recycling of ships to increase in 2024 but the fleet could still grow by nearly 2.8m teu and by end 2024 exceed 30m teu for the first time in history.

While BIMCO is forecasting the container fleet capacity will grow 10% this year, the shipping organisation has warned that container trades are expected to grow significantly slower, increasing the demand for ship capacity by 3-4% in 2024.

In the meantime, the average sailing speed of container ships has reduced from 14.3 knots in 2022 to 13.9 knots in 2023 and could fall further in 2024, according to Rasmussen.

To read the rest of the magazine for free online, click here.