Shipping in the Year of the Dragon: Dry bulk

How will dry bulk fortunes differ from what materialised last year? The second installment in our brand new issue of Maritime CEO giving readers a sense of what to expect in the months ahead.

Any dry bulk forecast must start with the state of the Chinese economy.

In late January, a Hong Kong court ordered the liquidation of the Evergrande Group, bringing an end to two years of financial instability during which the company struggled to meet its debt obligations. This development underscores concerns about the economic challenges facing China, as the property sector represents about 25-30% of the nation’s GDP and approximately a third of the country’s domestic steel demand.

Despite, or maybe because of the court ruling, broker SSY is constructive on the Chinese steel complex going into this year, contrary to most macroeconomists.

For one, the property market correction in China has now been ongoing for nearly four years, which means that the sector is smaller relative to the other sectors driving steel demand – from approximately 40% share of domestic steel demand in 2020 to an estimated 33% in 2023. Secondly, the other sectors — notably auto manufacturing, shipbuilding, infrastructure and manufacturing — showed strong growth throughout 2023 and have the continued support of Chinese policymakers for 2024.

Similar to last year?

For coal, SSY sees a decline in Chinese imports this year, but the London brokerage is predicting India and Southeast Asia will pick up that demand slack, leaving global coal trade stable at current record levels.

The research team at SSY, led by Dr Roar Adland, sees overall dry bulk tonne-mile demand growth moderating to 2.7%, which happens to be on par with SSY’s projected fleet supply growth at 2.6%.

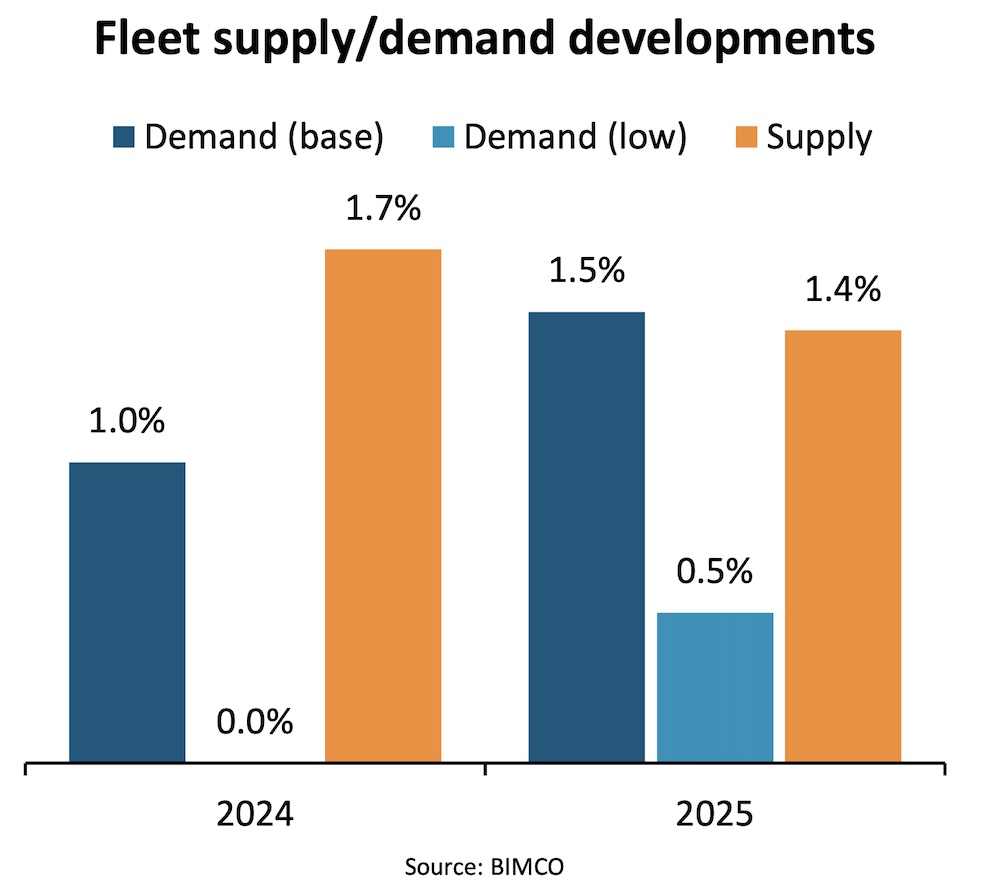

In BIMCO’s base scenario for the dry bulk sector as a whole, meanwhile, the shipping organisation expects cargo demand to grow by 0-1% in 2024 and 0.5-1.5% in 2025. Average sailing distances are expected to lengthen 0-1% in 2024 and in 2025, BIMCO forecasts. From 2024, it expects a decrease in shipments of coal – a commodity with below average sailing distances. Conversely, iron ore, bauxite and grain shipments from South America and Guinea, which have above average distances, could continue to rise.

The $64,000 question becomes whether stronger rates for the larger sizes will pull up the smaller sizes or be capped by them

BIMCO has warned it expects the supply/demand balance to marginally weaken in 2024 and remain stable during 2025. Supply is expected to grow by 1- 2% in both 2024 and 2025, while demand is projected to grow by 0.5-1.5% in 2024 and 1- 2% in 2025.

“Overall, we believe that the dry bulk market can look forward to the next two years being similar to 2023,” BIMCO stated in its latest dry bulk review.

Capes to lead

When looking at the individual size segments, capesizes look substantially stronger on paper, with SSY projecting 2024 tonne-mile growth of 3.3% versus a mere 1.3% forecasted fleet growth.

Panamaxes are not far behind – forecasted 4.2% tonne-mile growth against 2.7% fleet growth, while at the opposite end of the earnings spectrum geared vessels have a projected high 4.1% fleet growth and a modest 1% tonne-mile demand growth.

In terms of chokepoints – arguably 2024’s biggest headline-grabbing topic for shipping – around 7% of the global dry bulk trade would ordinarily transit the Suez Canal, while prior to droughts, there was no sector that had a bigger presence along the Panama Canal – dry bulk ships traditionally accounted for 23% of all dry bulk transits through the Central American nation, something that has been turned on its head thanks to El Niño in recent months with the handy segment especially hard hit.

The dry bulk market can look forward to the next two years being similar to 2023

Peter Lindström, the head of research at Torvald Klaveness, reckons the Suez and Panama diversions have made for an increase in dry bulk utilisation of 2.6% this year, and 3.3% specifically for the panamax sector.

Bullish Dragons

Reasons to be bullish going into the Year of the Dragon include the fact that capesize spot rates are at 15-year highs for this time of year.

“The Atlantic market remains the main driver of such an astonishing yet surprising performance, while the reasons behind the current strength all point to inadequate vessel supply in the western hemisphere,” Breakwave Advisors noted in a recent report, which predicts a spot market that remains strong for a long period of time.

Freight futures have already priced-in such a scenario, with the next two years now showing above $20,000, a stretch of strength that has not happened since the late 2000s for capesize vessels.

Returning to SSY in conclusion, the London broker mused recently: “The $64,000 question then becomes whether stronger rates and market sentiment for the larger sizes will manage to pull up the smaller sizes or be capped by them. While we lean towards the latter from a fundamental point of view, the market action of last November and December showed how positive Capesize sentiment can quickly cascade down into the smaller sizes, lifting rates across the board.”

To read the rest of the magazine for free online, click here.