Last week saw the G7 group of countries – Canada, France, Germany, Italy, Japan, the United Kingdom and the United States – announce their intention to impose a globally recognised price cap on Russian oil exports as they strive to reduce Russia’s ability to finance its war in Ukraine, another measure that tanker analysts are sure will add to the increasingly highly favourable ton-mile picture for a sector firmly in the ascendant rates-wise.

December 5 will see the European Union ban on Russian imports come into effect too, something with added importance following the G7’s latest measures against Russia.

“Although the price ceiling has not been set, and few details are known, the intention is that the measure will be implemented and enforced in the wider shipping market by prohibiting finance and insurance for seaborne carriage of Russian oil sold above a certain price,” experts at brokers Lorentzen & Co noted this morning, discussing the ramifications of the G7 announcement.

Most likely, Lorentzen predicted this will come on top of a majority of P&I clubs already pulling insurance for such trade, relegating seaborne trade of oil out of Russia to new parties more unbeknown to the market.

The tanker market is in for a wild ride

“[P]roviding that the cap is introduced properly and therefore does not deprive international markets of much-needed Russian oil, it should prove to be a boost to clean and dirty tanker ton mile demand,” tanker analysts at BRS suggested.

The G7 action could potentially accelerate the shipping of more Russian crude from western terminals on the Baltic and Black Sea to east of Suez markets, BRS said, which no matter whether it is aboard aframaxes, suezmaxes or VLCCs via ship-to-ship transfers will add ton miles. It could also accelerate the shift of Russian refined products away from Europe to the non-OECD, BRS added, which again will add ton miles across the whole clean tanker segment.

“All told, this suggests that ton mile demand will remain supported for as long as the Ukrainian conflict persists,” BRS stated in its latest weekly tanker report.

Shipping organisation BIMCO, meanwhile, estimates that the change in EU’s trading patterns will add 3-4% to both crude and product tanker demand on top of the general recovery in production and consumption, far more significant than the changes to Russian export patterns, which the shipowning body estimates will add another 1% to the above demand figure.

The changes in the European oil trades and their impact on the global tanker market were also the focus of the latest weekly report from tanker brokers Poten & Partners.

Europe still imports almost 2m barrels per day of crude oil from Russia, down 20% from the 12 months prior to the conflict, according to Poten data.

“Replacing this will need to come from longer-haul sources across the Atlantic, West Africa and the Middle East,” Poten pointed out.

The ton-mile demand generated by European imports increased by 32% as a result of replacing 500,000 barrels per day of Russian crude oil in the opening months of the invasion of Ukraine, Poten observed.

“Finding alternative sources of supply for another 2.0 Mb/d will provide another massive stimulus to ton-mile demand (and tanker rates),” Poten noted, adding that on top of this Russia will try to find alternative customers for its crude oil output, most likely in Asia boosting ton-mile demand further.

“The tanker market is in for a wild ride,” Poten concluded.

So far this year, the Baltic Exchange Dirty Tanker Index (BDTI) has on average been 86% higher than during 2021 and the Baltic Exchange Clean Tanker Index (BCTI) has on average been 113% higher.

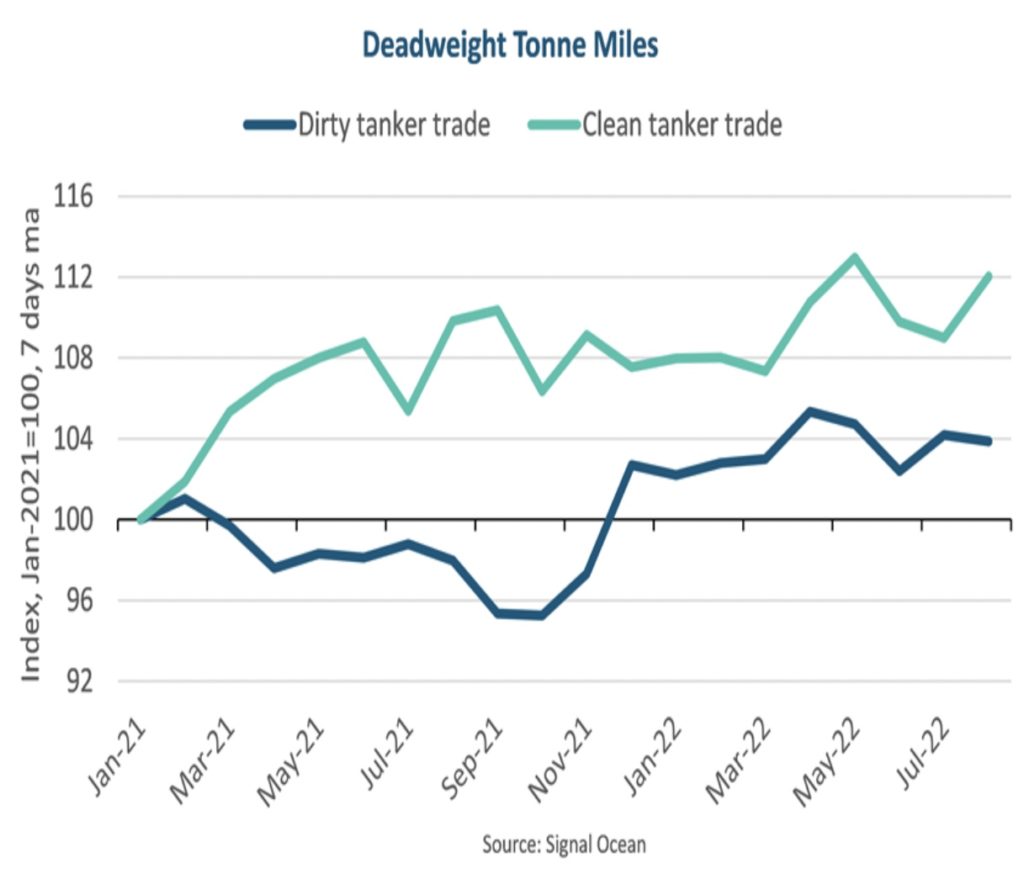

Year-to-date dirty tanker tonne miles have on average been 5.1% higher than the 2021 full-year average, whereas clean tanker tonne miles are up 2.9%, according to analysis from BIMCO.

BIMCO is estimating demand growth to approach 5% in 2022 and 2023 for both markets.

“While uncertainties remain, everything points towards a solid strengthening of both the crude and product markets in 2023, and higher freight rates, time charter rates, and secondhand ship prices,” commented Neils Rasmussen, chief shipping analyst at BIMCO.