The year ahead in ship finance

As is customary at this time of the year the editor asks me for my take on key themes in ship finance that readers ought to be aware of in 2021. By and large, I see the trends that have been coalescing through ship finance over the past five years or so continuing next year.

Big banks will further withdraw from shipping and other smaller industries. Make no mistake, banks are in big trouble, slashing staff across the world. The banking industry is in transition and has to focus on survival – shipping is too small fry for most of them.

Shipping as a whole is so inconsequential on Wall Street

As in previous years, some smaller banks based in places such as Norway, Germany, Cyprus and Greece will up their game in shipping in the coming year, albeit they are starting from a very small base and with limited capacity.

Refinancing is now being done at far lower levels – 50% max with pricing far higher than owners are used to. They will have to get used to that next year.

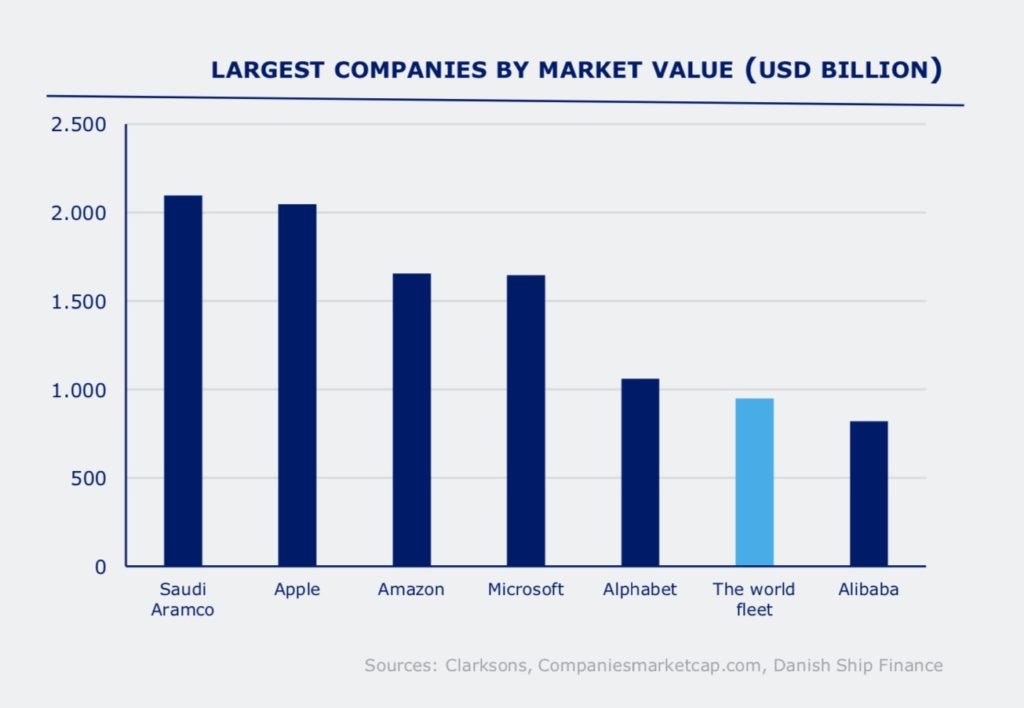

There is and will be absolutely no interest in the equity markets. Shares are so undervalued at the moment. I loved the quote the other day from Flex LNG’s Oeystein Moksheim Kalleklev who pointed out that his ships are considerably cheaper on the stock exchange in Oslo and New York than at the newbuilding yards (P/B ~0.45x). US-listed shipowners’ market cap this year has slid from around $30bn to duck below $20bn. Shipping as a whole is so inconsequential on Wall Street as brilliantly highlighted from this recent slide from Danish Ship Finance and it is not attractively green enough yet.

Here’s the funny thing though. Despite the negativity at the start of this article, I genuinely think we’re at the start of a rather strong cycle, not a 2003 Chinese super cycle I grant you, but something that will see solid earnings in 2021 and 2022 based on the ongoing very limited orderbook.

There’s almost no contracting for ships these days – no one knows what to order and two words – stranded and assets – haunt owners like never before. Regulatory uncertainty is keeping a lid on newbuilds, making today’s fleet more valuable and likely working towards their full technical lifespans.

Next year, there will be a strong post-Covid stimulus programme enacted in most major economies, which will drive the markets. I can’t see demand lasting too long however – the deleterious effects of this pandemic on government coffers and the public’s wallet will have to come to roost at some point. It will be a miracle if we get back to end-2019 demand levels by the end of 2021.

One final point, this is shipping and making any predictions – especially after the crazy, topsy-turvy year we’ve just endured – are nigh on impossible. Let’s check in this time in 12 months to see how well I did.

This article first appeared in the latest issue of Maritime CEO magazine, published this week. Splash readers can access the full magazine for free by clicking here.

Shows for success one shall start a company that starts with “A”

else very interesting read – thanks for your insight Dagfinn