Trajectory of soaring newbuild prices divides opinion

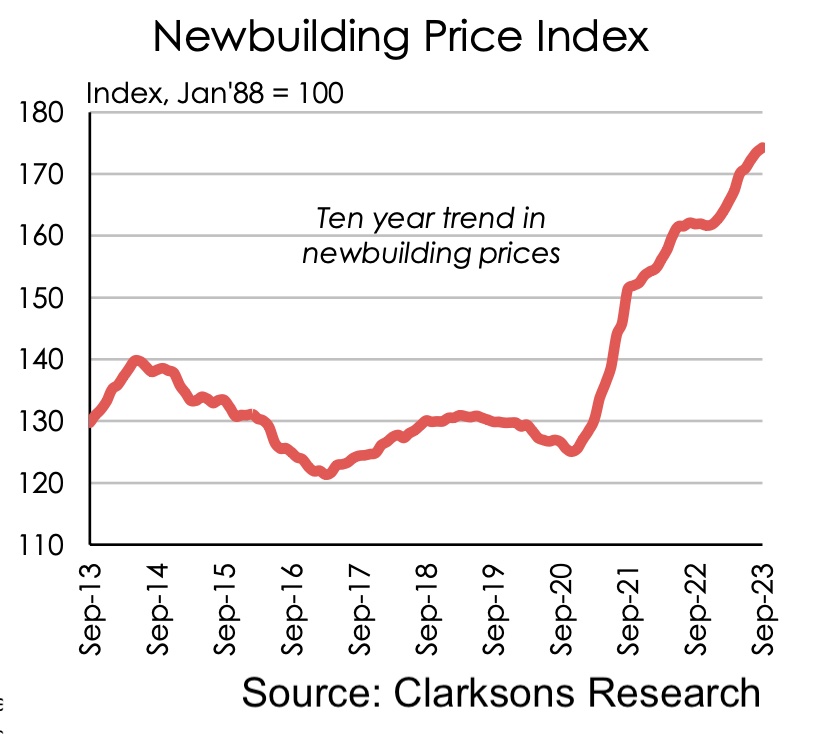

The trajectory of newbuild prices which have soared up by as much as 50% in less than three years is dividing experts with owners facing tricky decisions on when to kickstart fleet renewal programmes ahead of stricter 2030 green targets for shipping agreed at the International Maritime Organization this July.

ABS has this week joined a host of other class societies in publishing its vision for how shipping will transform through to 2050.

Contained in the 178-page report, which features data from UK consultancy Maritime Strategies International (MSI), is a supposition that newbuild prices might finally cool down, a point of view not widely shared with shiproking houses contacted by Splash today.

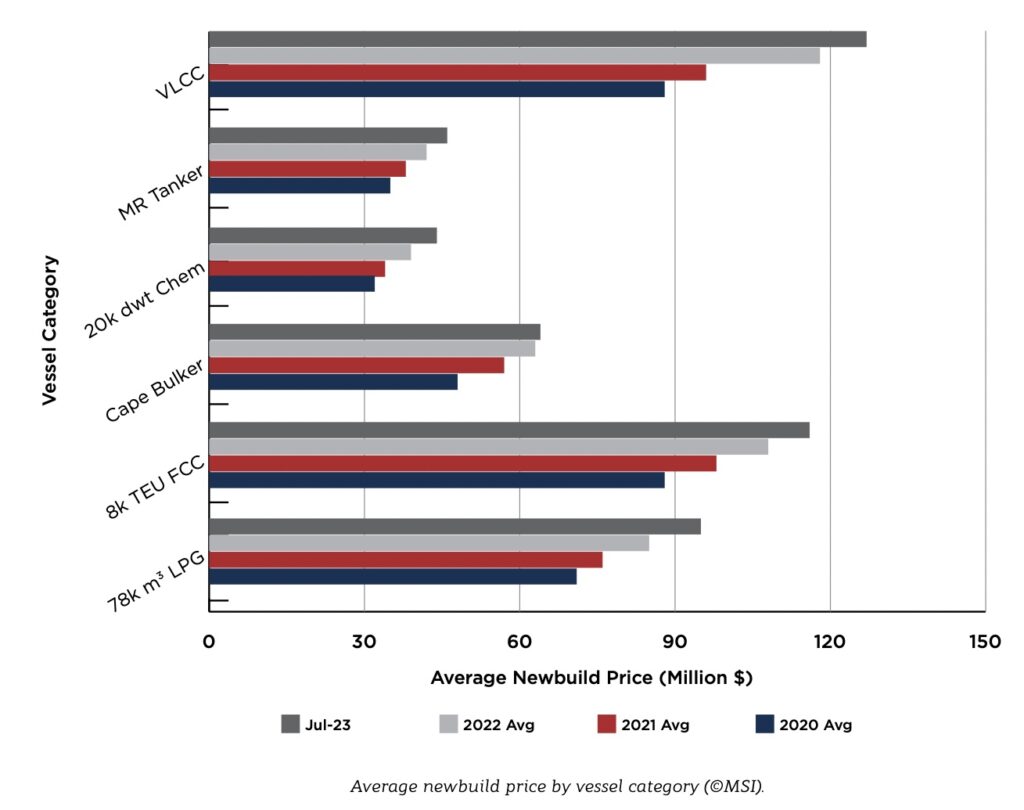

“A defining characteristic of the shipbuilding market in recent years has been a surge in newbuilding prices,” the ABS report states. At the start of August 2023, benchmark newbuild prices stood around 30-50% higher than they were at the end of 2020, according to data from MSI.

This rise in prices, as elaborated in the ABS guide, was partly driven by the strong newbuilding interest and the subsequent firming of forward cover at major shipyards. However, other factors have been at play at various points over the last few years. The most significant of these have been elevated steel prices, significant fluctuations in the exchange rates of the Asian currencies against the US dollar and general inflationary pressures. Another significant factor was the reduction in shipbuilding capacity over the last decade.

“[T]he industry is at the peak of the current newbuild price cycle,” the ABS report argued, adding: “Moving forward, prices are expected to drop over the next few years as the factors that supported prices, most notably the high steel prices and elevated forward cover, unwind.”

However, rising shipyard costs are also expected to put a floor under the declines, and the low forecast in newbuild prices for 2025 will be significantly higher than pre-pandemic levels, according to ABS and MSI forecasts.

Data from Greece’s Xclusiv Shipbrokers suggests that at least for dry bulk carriers a peak might have already been reached.

“Dry newbuild prices have eased from their 14-year highs we saw during second half 2022,” said Eirini Diamantara from Xclusiv’s research & valuations department.

Xclusiv Chinese newbuild prices for kamsarmaxes and ultramaxes are around $35m and $33m respectively, almost 6% and 4% down compared to 2022’s highs. Newbuild prices for capesize and handysize are almost at the same levels – $64m and $30m – compared to 2022’s highs.

However, for tankers, Xclusiv data shows prices are at highs not seen since early 2009 with prices firming in 2023 by between 6 to 9% depending on ship size.

Also of note in the newbuild price debate, steel has decreased by 14% since March 2023, and is 37% down compared to October 2021 which was an all-time high.

Not everyone is convinced however that newbuild prices are close to peaking.

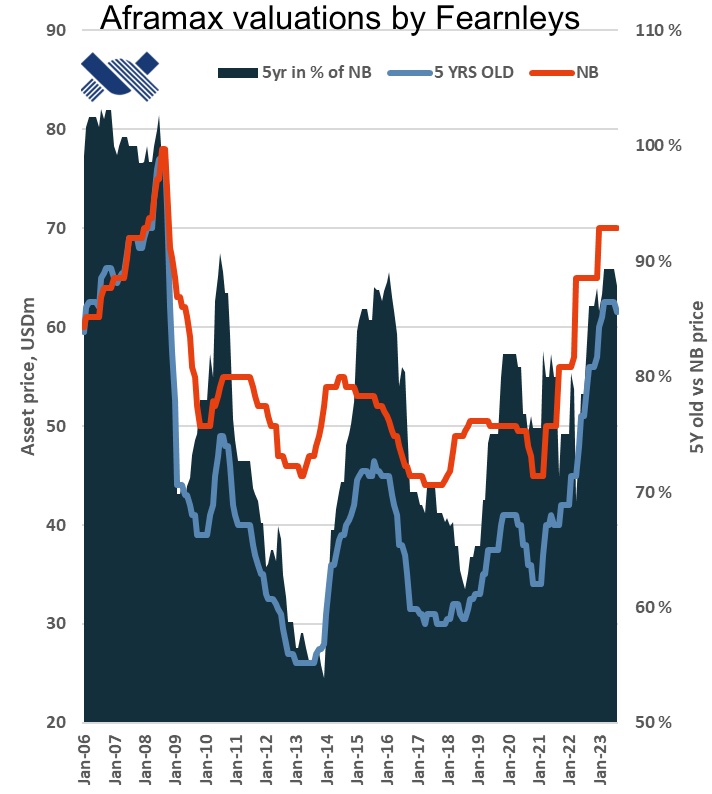

Dag Kilen, head of research at Norwegian broker Fearnleys, told Splash today: “There’s no reason for peaking or declining newbuild prices unless there is a macroeconomic event.”

“Yards have got the longest backlog in history with 2026 soon full so they don’t have to rush into anything,” Kilen observed, pointing out that only the container sector had a real prospect for fleet renewal towards the end of the decade. LNG newbuilds, which have flooded in at record levels this decade, will mostly be absorbed by new projects from 2025/26 rather than renewing the aging part of the fleet, the Fearnleys analyst argued.

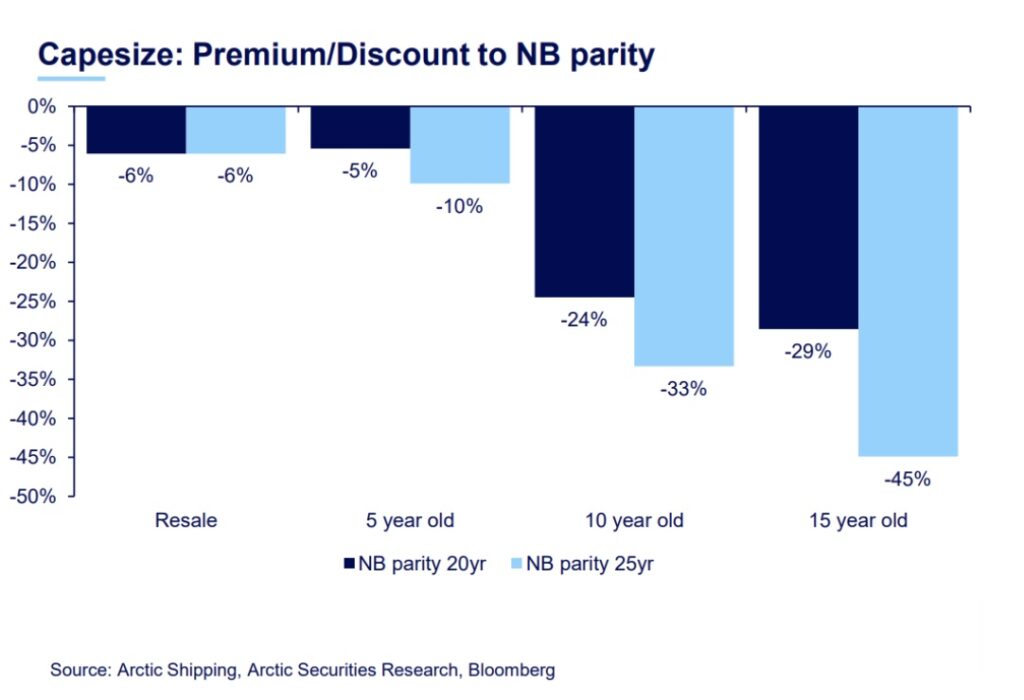

“Most other segments have multi-year low orderbooks but high replacement requirements towards the end of the decade,” Kilen said, maintaining the newbuild squeeze would prop up secondhand prices too.

Kilen pointed towards five-year-old aframaxes as an example to help frame his argument. They stand at 88% of newbuilding prices, with newbuildings only delivering three to three-and-a-half years away, and aframaxes making headlines this week being tied up for five-year charters at very solid levels.

“There’s no sign yet that newbuild prices are close to peaking,” said Giuseppe Rosano, founder of London-headquartered brokers Alibra Shipping.

“Newbuilds will always attract the public-listed companies as a means to push boundaries and be innovating with their designs, which thus attract investors,” Rosano said.

A copy of the chart-laden ABS 2023 Outlook is available for download here.

The sensible thing to do in these circumstances is surely to start talking to your Class Society and repair yards about extending the life of existing ships and seeing what can be done to improve their emissions, and starting to plan for a “post-2030” fleet, rather than rushing to get under the bar with a late build of an out of date ship?