Transpacific leaderboard shake-up

The significant reshaping of the transpacific leaderboard during the pandemic has been charted in a new report from Linerlytica.

Newcomers to the key box tradelane have carved out a 4% market share since 2019, while the carrier with the biggest growth on the route is Mediterranean Shipping Co (MSC), which has chalked up a 160% increase in liftings in the first six months of 2022 compared to the same period in 2019.

However, according to Linerlytica, MSC has struggled to maintain the growth momentum since the start of the year as it is heavily reliant on the weakening spot market.

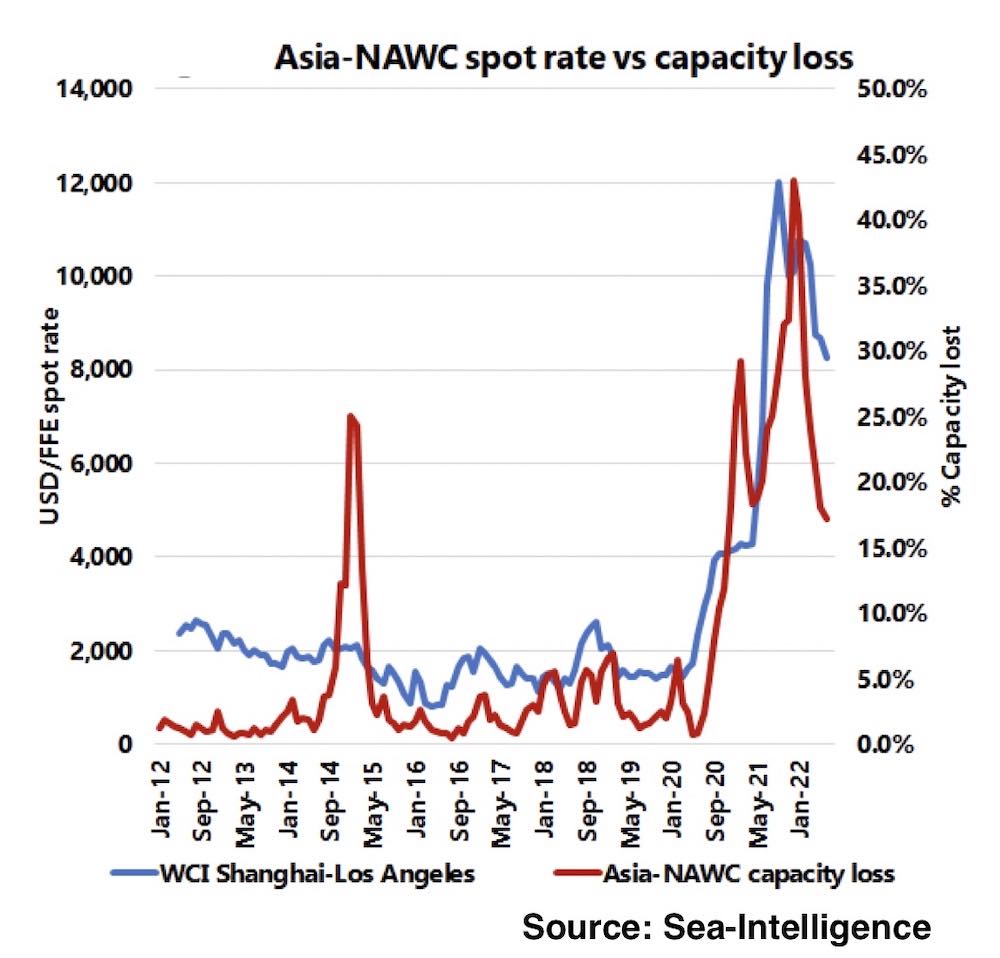

Declining rates and the link to congestion has been highlighted by rival box analysts, Sea-Intelligence, in a new report.

At the height of the transpacific congestion crisis in December last year, 43% of the capacity deployed on the Asia-North America west coast route was lost to congestion and vessel delays, but this capacity loss has improved in recent months, falling to 17.2% in June this year. As a consequence, Sea-Intelligence pointed out that spot rates have declined in step from their record of $12,000 per feu.

On the transpacific utilisation rates dropped below the 90% level in mid-July for the first time since mid-2020, according to Sea-Intelligence who said that this implies that capacity is finally beginning to open up.

The big loser on the transpacific in terms of market share has been Japan’s Ocean Network Express (ONE), which has seen its liftings decline by 5% compared to overall market growth of 41% over the 2019-2022 period, according to Linerlytica.

Independent carriers have made big strides, with Zim growing by 77%, Matson by 239% and Wan Hai by 386%.

Where did MSC suddenly acquire all that capacity and who/which trade from are questions needing answers.