SC Lowy: Predicting private equity’s exit

Hong Kong: A Hong Kong independent fixed income specialist has made quite an impact in shipping during the downturn.

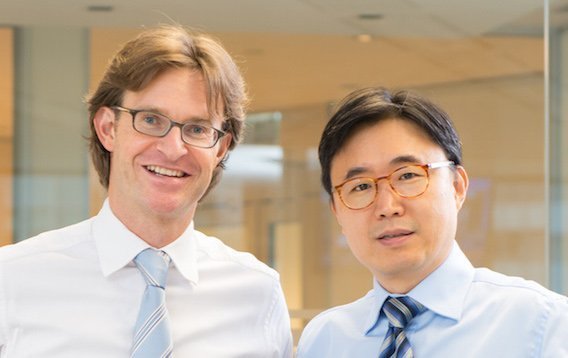

“Our radar has a wide sweep and we try to pick up anything going through restructuring,” explains Soo Cheon Lee, the company’s co-founder, pictured right with fellow co-founder Michel Lowy. These include companies like Nanjing Tanker, Nautilus, BLT, Zim, Torm, and Pan Ocean. SC Lowy is now one of the largest creditors in Pan Ocean.

“In any shipping restructuring deal, we’ll have our foot in somewhere,” says Lee. The company’s product range includes: purchase of claims against defaulted counterparties to provide liquidity and reduced legal risk, mezzanine financing to bridge liquidity gaps, finance capital maintenance or improvements to extend the life and profitability of vessels and providing finance to support fleet expansions.

With banks now only lending 50% to 60% of loan to value, down from a pre-Lehman average of 80%, there is a good opportunity for the likes of SC Lowy, which specialises in distressed debt financing.

“We’re unique in that we’re not a classic ship finance bank by any means, but we understand the industry,” Lee relates. Prior to SC Lowy, Lee headed up Deutsche Bank’s distressed assets group in Asia Pacific. Before that, he was a senior research analyst at Cargill.

“Major banks of course have a balance sheet,” he says, “but they are under severe regulatory restraints because of their past lending activities, a situation that affects their appetite for shipping risk. Shipping is only a small portion of their risk concerns, so therefore demands only so much of their attention.”

One possible avenue of expansion for SC Lowy is to get involved in a JV as support and co-investor with a company that is restructuring debt and altering their model. There are many shipping companies in this position today, Lee notes.

Shipping, Lee says, has never fully shaken off the impact of the global financial crisis. The problem is that now with private equity and hedge funds coming in so strong, capacity has built up once again threatening the future stability of rates in many ship classes, from capesize bulkers to containerships.

“The nuance here is that private equity is by definition a type of investor that requires an exit, often over a shorter time horizon than it takes for shipping cycles to turn,” Lee observes. How will these investors approach exits if the companies they have stakes in or control are in a sector are in loss-making businesses? That’s one question that will vex the market in the upcoming three to five years, and may well bring plenty of opportunities for SC Lowy. [27/11/14]