Shipping in the Year of the Dragon: Tankers

More than healthy earnings are on the cards for tanker owners in 2024. The latest installment in Maritime CEO’s annual outlook.

A potential scrapping of much of the dark fleet, belated ordering en masse, and a highly profitable year. That’s the tanker outlook in the Year of the Dragon without even taking into account the shut-out of the Red Sea.

McQuilling’s prevailing view for the crude tanker markets favours mid-sized tankers over VLCCs in 2024 as major VLCC hubs – Middle East and West Africa – reveal tighter crude balances.

McQuilling’s base case 2024 TCEs is $45,900 a day for VLCCs, while aframaxes and suezmaxes outperform at $55,000 a day and $50,200 a day respectively, basis eco tankers without scrubbers. McQuilling calculations amid Red Sea developments reveal a negative impact (-$8,300 a day) on VLCC earnings should Saudi Arabia maximise its East-to-West Pipeline throughput, while aframax TCEs may increase by $42,400 a day from the base case.

Scheduled newbuilding deliveries in 2024 will hit lows not seen for more than 20 years

Turning to product tanker earnings McQuilling projects LR2s to earn $56,500 a day in 2024, basis eco tankers without scrubbers, out-earning MRs by 40% excluding Red Sea impacts.

Secondhand values for aframax and LR2 tankers have the most upside over the next two years, McQuilling is forecasting.

Red Sea bonus

The Middle East continues to be a vital part of the global oil market, both in terms of production from nations in the region, and a bottleneck in global seaborne oil supply chains. By mid-February, roughly one in two tankers on routes between Asia and Europe had opted to give the Houthi missiles a miss, adding significant tonne-miles to a sector that is already running at very high utilisation levels.

At 12 knots, the journey time for a Jubail-Rotterdam voyage via the Cape of Good Hope increases by 16 days to around 39 days compared with the same route via the Suez.

“This is creating greater fleet inefficiency and that will continue to underpin rates in the short-term until owners and charterers deem that the risk on Red Sea transits has lessened,” broker SSY noted in a recent report.

In Clarksons Research’s stretch case scenario, the London broker assumes the disruptions will be ongoing with 90% re-routing on all affected trades and drive 5.5% uplift in global tonne-miles; container and crude to rise 10% and product tankers by 20%, with bulk seeing just 2% uplift. However, Clarksons believes that the tanker segment will see more shifts in trade flows to offset the re-routings.

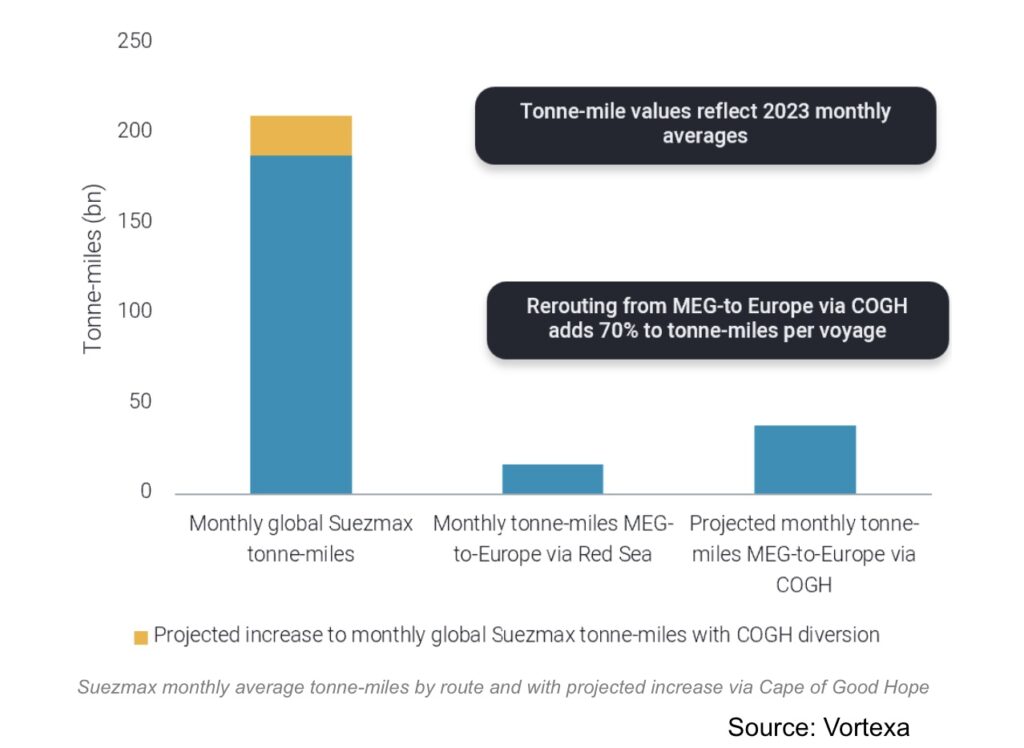

The tanker vessel class most impacted by the Red Sea diversions is suezmax, likely leading to a spike in earnings. However, if the Red Sea crisis is prolonged charterers may well look to parcel two suezmax cargoes onto one VLCC.

Diverting via the cape adds about 4,900 nautical miles to the voyage and over two weeks in voyage length. This increases tonne-miles for a single voyage by around 70%, according to Vortexa.

Using 2023 data, Vortexa has projected the impact to this vessel class if this rerouting continues. On a monthly basis, tonne-miles for suezmaxes carrying crude from the Middle East to Europe would increase about 130% if transits occur via the cape instead of the Bab el-Mandeb strait. With the incremental increase from the extra tonne-miles for these specific cargoes, monthly global suezmax tonne-miles would increase by around 10%.

However, analysts at Gibson warn that at some point charterers will look at the economies of scale afforded by larger VLCCs if the Red Sea lock-in remains in place for months rather than weeks.

Another chokepoint, the Panama Canal, is expected to keep daily transits to no more than 24 a day, down from a maximum of 40, until deep into Q2 likely impacting clean tanker trade flows in the near-term.

Analysts at SSY suggest the west coast of the Americas may seek more refined product supply from Asia to meet a shortfall in supply from US Gulf refiners.

Shadows wane

Analysts at Vortexa issued a recent report showing that tankers operating in opaque markets reached a record high in Q2 last year and have since declined.

The latest data from BRS suggests there are a total of 675 tankers in what it terms as the grey fleet, representing 7.4% of the total global tanker fleet.

In the opening weeks of the 2024, hard pressed shadow tanker operators, struggling under stricter sanction regimes, have started to scrap ships.

The peaking of the shadow fleet is also reflected in the sale and purchase market recently with prices for vintage VLCCs coming down noticeably in January and February. .

Belated newbuilds

With one announcement from China, the tiny global VLCC orderbook swelled by 60% on February 7.

Dalian Shipbuilding Industry Co (DSIC)scooped orders from two famous European owners for up to 14 VLCCs worth a total of $1.8bn.

John Fredriksen-led Seatankers contracted the Chinese yard for six firm conventionally fuelled VLCCs with options for two more, while Evangelos Marinakis’s Capital Maritime & Trading has come in for four firm LNG duel-fuel VLCCs in a contract that comes with options for two more. All the ships will deliver from the end of 2026 and heading into and throughout 2027.

Prior to these bumper orders, the VLCC orderbook was one of the smallest of all sectors in the world, with Clarksons Research listing just 23 VLCCs on order as the start of February.

Across the tanker segment, the restraint in ordering is expected to ease this year with owners keen to renew their fleets despite the high newbuild price environment.

Uncertainty over future fuels, high asset prices and yards previously being full with gas and container orders had capped tanker contracting to the point whereby this year will see scheduled newbuilding deliveries hit lows not seen for more than 20 years.

To read the rest of the magazine for free online, click here.