Shipping should shrug off coronavirus but escalation risks supply chain contagion

In the first of a two-part analysis on the impact of the coronavirus, Dr Adam Kent, managing director, MSI looks at the dry bulk and tanker sectors.

The impact of the coronavirus on the Chinese economy has already been severe and the scenarios for shipping range from a quick resolution to a long drawn out impact. In modelling the likely effects, MSI has analysed how the virus is affecting shipping sectors now and what the future implications of a further escalation might be.

Each sector has been affected to a different degree by the crisis so far, and each has a different set of vulnerabilities to escalation or prolonged disruption.

Vessel earnings in the tanker segment have already seen a negative impact and are exposed to continued disruption to oil demand. For dry bulk the Coronavirus has worsened an already-challenging environment.

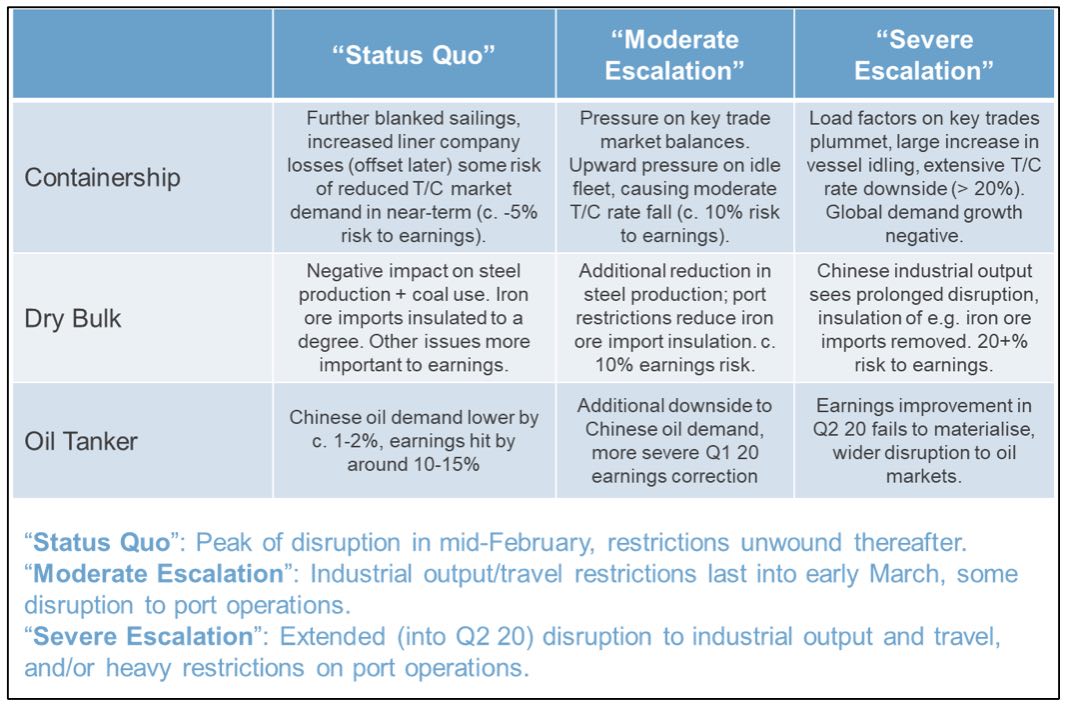

The MSI risk matrix depicts how different segments will be affected by the status quo in which we expect that the disruption peaks over mid or late February and then restrictions to output and mobility are unwound thereafter.

We add a moderate escalation scenario in which disruption continues into March and there’s some restriction on port activity over that period of time, which again implies further downside risk to vessel earnings.

Lastly we model a severe escalation scenario in which the impacts last well into Q2 forcing a continued shutdown or increased shutdown of Chinese factory output or significant disruption to Chinese port operations. In that case the market should expect double-digit downside risk to vessel earnings in the different segments.

Dry bulk fallout

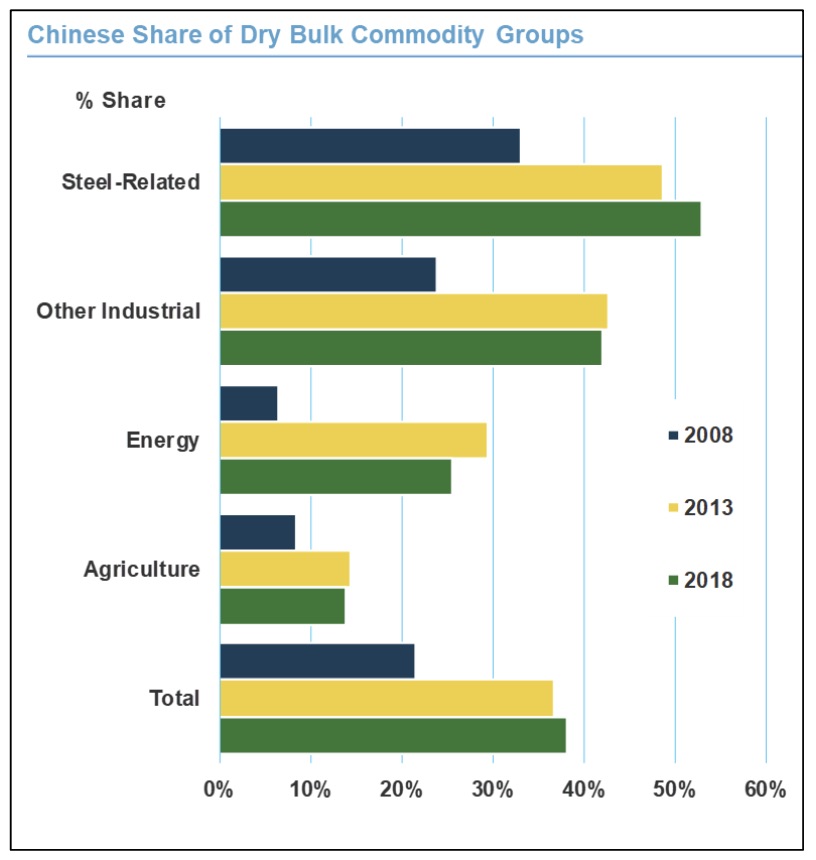

Turning first to dry bulk, the potential impact of the coronavirus is huge, given that China imports around 40% of global dry bulk cargoes.

Chinese industrial production and demand for dry bulk imports have already been severely hit by the virus, the result of extended factory closures and reduced worker mobility. Critically for dry bulk, however, those same disruptions also impact domestic production of raw materials, so to understand dry bulk import demand we need to examine the balance between production of goods and domestic inputs and to what extent imports are filling the gap.

MSI believes that due to the significant near-term slowdown in the construction sector, steel production in China fall by about 3% in 2020. However, we believe that basic oxygen furnace output will be more resilient than electric arc furnace output and, as a result, iron ore imports will be relatively insulated from that initial fall in steel production.

In addition, on a year-on-year basis, the supply of iron ore is much improved from last year when the Vale dam collapse slashed output. So far, we have not seen massive disruption in chartering demand from Brazil for iron ore beyond the usual Q1 weather-related issues, and so, provided the status quo holds, we expect Chinese iron ore imports to increase by about 3% in 2020.

Weak industrial output will also affect power demand and, unlike with the iron ore segment, the interaction between coal demand, domestic coal production and imports is likely to disadvantage imports this year. This is for the simple reason that the Chinese authorities will likely choose to protect domestic coal producers at the expense of importers, causing Chinese coal imports to fall by about 6% in 2020. We do note some upside risk to this view, however, should domestic production be curtailed by a delay in the migrant workforce returning to the mines.

Combined, these expected impacts on trade are not ruinous. The most significant risk at the moment, though, is the fragility of the transport network. Even if fundamentals support imports, without an effective supply chain from ports through to rail and road networks in China the dry bulk industry will suffer.

Tanker declines accelerate

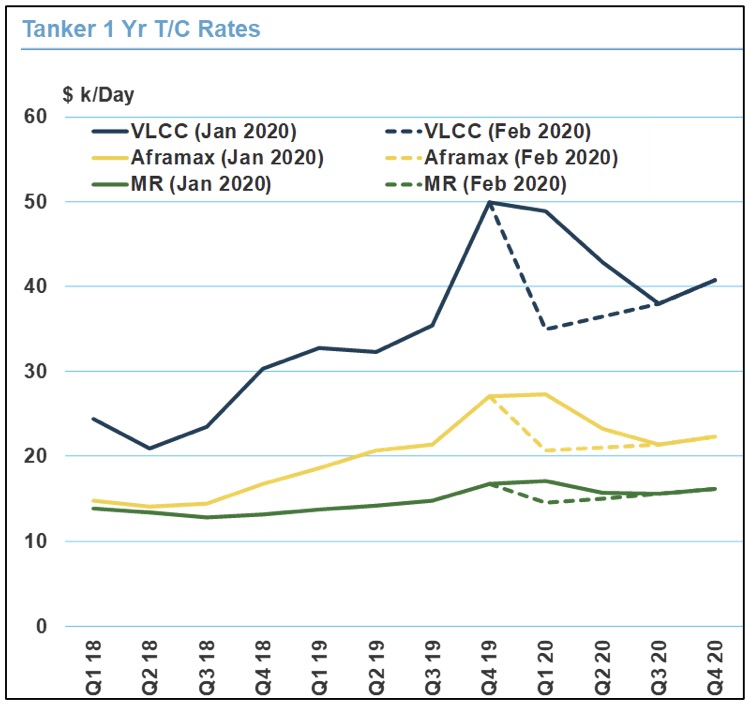

The tanker market is really where we’ve seen the greatest initial impact from coronavirus on markets. Tanker markets are already seeing substantial downside, with sharp declines in spot markets after a strong start to the year. The IEA have stated that global oil demand is likely to contract in Q1 20 as a result of the coronavirus, the first time this has happened since 2009. China’s oil demand is experiencing severe shock and could drop by more than 3 Mn b/d (c. 25%) in February.

China accounts for about 14% of global oil demand, but 22% of global crude trade as estimated by MSI. Moreover, it was the key growth driver in 2019. Net growth in global crude imports was effectively flat last year, while China saw an 8.9% increase. This year will be markedly different with Chinese refiners cutting throughput substantially in Q1, although our Base Case view is that conditions will normalise in Q2. Until then, vessel earnings will continue to decline across Q1.

The impact of coronavirus will not just be in China itself. With oil prices having fallen by around 15% between mid-January and mid-February, OPEC may decide to take even more substantial action in a meeting scheduled for early March. Against a backdrop of plummeting Libyan exports, as well, crude cargo volumes will be under pressure across H1 20 as a result.

In terms of markets, it should be noted MSI already expected a weakening of tanker time charter earnings over the course of 2020 as the earlier impetus from IMO 2020 and sanctions faded. What we have seen so far from coronavirus is an escalation of these trends, with further downside risk if there is further escalation.