Suez blockage sparks box spot rate rally

Shippers have another reason to rue the Ever Given. The repercussions of the giant ship’s grounding on the Suez Canal late last month are now filtering into the container spot market. Box spot rates peaked in mid-January and had been gently cooling off in February and March until the huge Evergreen-operated 20,388 teu containership became lodged in the eastern banks of the key Middle Eastern waterway.

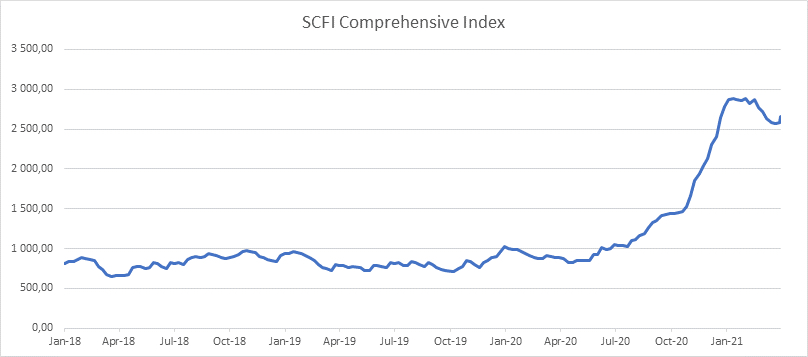

The Shanghai Containerized Freight Index (SCFI) rose for the first time in many weeks on Friday, up by 2.6% to 2,652.12 points.

Rates from Asia to North Europe and the Mediterranean increased, while transatlantic rates and spot prices from Asia to the US east coast leapt.

Asia to North Europe spot rates increased to $3,964 per teu. Asia to US east coast leapt to an all time record of $5,334 per feu while transatlantic rates hit a multi-year high of $2,851 per feu, up 30% week-on-week.

The Suez incident has been the last straw that broke the proverbial camel’s back

“Vessels delayed by the Suez blockage will soon start to arrive in ports in Europe and on the US East Coast. It’s likely that some ports will experience congestions, while other ports could be skipped as the liners would make an effort to minimize delays. Lack of equipment is another expected consequence of the incident,” brokers Lorentzen & Stemoco noted today.

Analysts at Sea-Intelligence said in a report published on Sunday that for shippers the Suez incident was “the last straw that broke the proverbial camel’s back”.

Before the Suez incident, Sea-Intelligence explained, many cargo owners were already trying to balance two different considerations. One consideration was how to get a good freight rate settled – ideally one that did not break the logistics manager’s budget. The other consideration was to make absolutely sure that the products could actually be moved, within the timeframe needed.

Pre-Suez there was already a growing worry that with the operational bottlenecks still not being resolved, it would be a legitimate concern that some products might actually not find the space needed on the vessels – or the empty containers necessary, hence why so many shippers have decided to sign contracts over the past few weeks at rate levels much higher than what they would normally be comfortable with.

“The Suez incident will have the effect of prolonging the operational capacity problems, and likely serve as a ‘push’ for more cargo owners to choose the ‘rock’ of higher prices, over the ‘hard place’ of seeing their product stuck at origin – which in turn would sustain the high rate levels for quite a while longer,” Sea-Intelligence suggested.

“Strong demand coupled with the disruption in capacity due to the congestion at the Suez Canal have boosted rates higher in recent weeks. Global demand for containerized goods remains robust as consumers continue to prefer goods over services due to COVID. As such, we expect container freight rates and charter rates to remain elevated this year,” investment bank Jefferies stated in a new shipping report published today.

Clarkson Research Services was equally optimistic when looking at 2021’s projected container supply/demand picture in a report published on Friday.

“Near-term containership market outlook remains positive, with support from firm box trade volumes (projected increase of 5.7% across 2021) and continued regional port congestion and logistical disruption (including from the recent Suez Canal blockage), against a backdrop of ‘manageable’ supply growth (4.0% in 2021),” Clarksons predicted.

Meanwhile, in Egypt a hardball game continues between the Suez Canal Authority and Shoei Kisen Kaisha, the Japanese owner of the 199,629 dwt Ever Given, with the Egyptians refusing to let the near fully laden vessel continue on its voyage to Europe until very significant penalties have been paid. General Average security will be required from all cargo interests prior to the eventual delivery of their cargo.

. The repercussions of the giant ship’s

. The repercussions of the giant ship’s