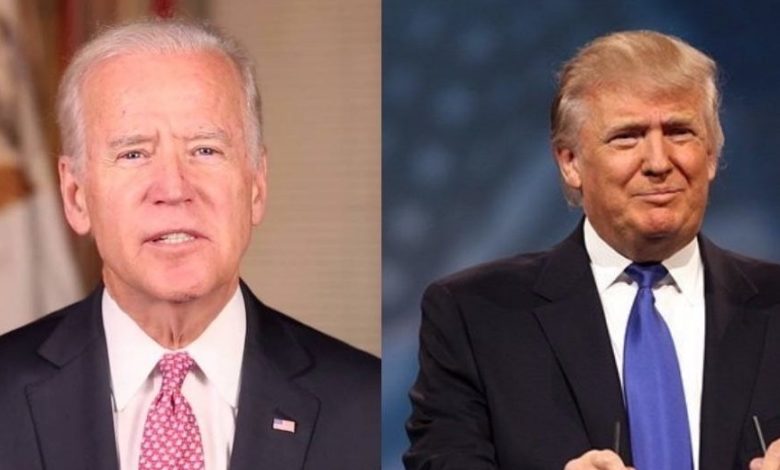

What the battle for the White House means for global shipping

With the US election just six days away, we asked Dr Adam Kent, managing director of Maritime Strategies International, for his take on the ramifications of the result for international shipping.

Whether Donald Trump has been good or bad for shipping will largely depend on the shipping sector in question.

Undoubtedly, fossil fuel production and exports have been given a shot in the arm by the Trump administration with a deregulatory agenda supporting US energy production. Since 2017 the US has become the world’s number one oil producing nation and has emerged as the fastest growing producer of LNG. This has in large been beneficial for shipping, as US exports have displaced cargoes on shorter haul trades.

Compared to when Trump was elected today there are twice as many LNG vessels employed servicing US LNG exports

At the start of 2017 the US was only exporting crude to around 20 countries, the total number of trading partners has more than doubled over the course of the Trump administration, with volumes tripling over the same period. US crude exports have been further supported by the re-imposed and tightening sanctions on both Iran and Venezuela, along with any company involved in oil trades out of these blacklisted countries. This has caused a gap in crude flows which the US has, in part, been able to step in and fill, boosting the tonne mile component of tanker demand.

LNG exports have played a central role in Trump’s trade policy and he has actively promoted US LNG with foreign governments and heads of state. Trump has also, during the Covid-19 pandemic ordered the Interior Department and other agencies to scale back on environmental reviews in order to speed up infrastructure projects associated with gas exports such as terminals and pipelines. Compared to when Trump was elected today there are twice as many LNG vessels employed servicing US LNG exports.

The US-China trade war and the wider placement of tariffs on a number of goods imported into the US has undoubtedly hit the container and car carrier sectors hardest. However, the speed at which the supply chain was able to react and the agreement in principal, concluded at the start of this year, has prevented permanent damage to liner companies balance sheets. Even though the trade war hit US soybean farmers hard, the ramifications on the dry bulk market were nowhere near as extreme, with Brazilian and Argentinian crops helping fill the void.

Who’s in the hot seat post the November election will have a significant impact on the role the US will play in terms of supporting shipping demand. If Trump remains in power the playbook will remain largely the same as the last four years with protectionism still front and centre on the agenda and a continued push on fossil fuels exports.

One of the areas Biden and Trump differ most in their views is on climate change. Biden’s goal is for all power generation to be carbon-emission free by 2035 and to re-join the Paris Climate Alignment, this would in time be a negative development tankers and gas carriers.

Biden’s stance on protectionism is also not as strong as that of Trump, which would take out some of the demand uncertainty witnessed over the last four years. Biden is also prepared to open up negotiations with Iran with the possibility of sanctions being eased over his term.

This would be a mixed blessing for some sectors of shipping, potentially returning commodities such as oil, LPG, methanol and ethylene to the international markets. In some cases, relative proximity to demand centres would be negative but for other commodities re-establishing old trade routes would boost demand. Returning sanctioned tonnage to the international trading fleet would likely be net negative.

For more on this subject, check out the October issue of Splash Extra where the likes of Martin Stopford, Roar Adland, Peter Sand and Randy Giveans discuss the merits of each US presidential candidate in terms of prospects for shipping.

Civil War is another possible scenario to consider if Biden wins with narrow margin.